Question: 11-5 Accounting question. Please answer in format shown Question Help Lucy Barber works at College of Portland and is paid $30 per hour for a

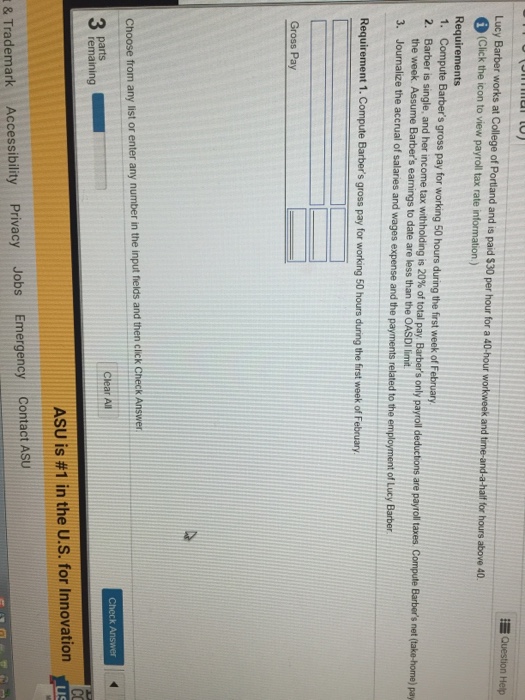

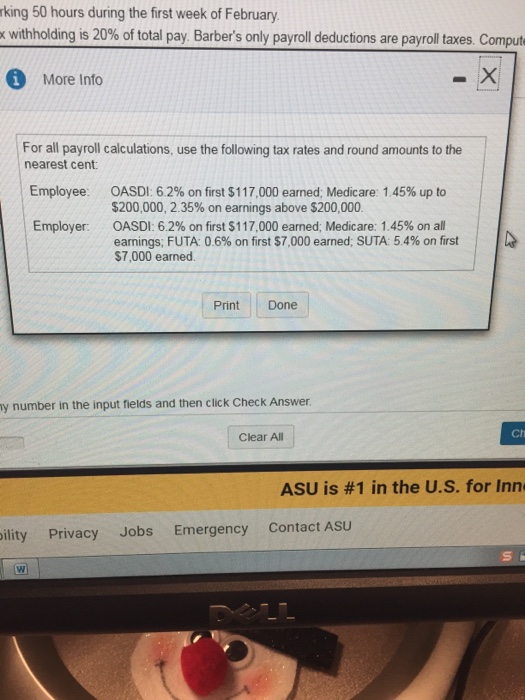

Question Help Lucy Barber works at College of Portland and is paid $30 per hour for a 40-hour workweek and tine-and-a-halt for hours above 40 (Click the icon to view payroll tax rate information ) Requirements 1. Compute Barber's gross pay for working 50 hours during the first week of February 2. Barber s inge, and her come tax withholding is 20% of total pay Barber's only payroll deductions are payroll taxes Compute the week. Assume Barber's earnings to date are less than the OASDI limit 3. Journalize the accrual of salaries and wages expense and the payments related s net and wages expense and the payments related to the employment of Lucy Barber Requirement 1. Compute Barber's gross pay for working 50 hours duing the fir Requirement 1. Compute Barber's gross pay for working 50 hours during the frst week of Frebuary Gross Pay Choose from any list or enter any number in the input fields and then click Check Answer Check Answer Clear All parts emaining CO uS ASU is #1 in the US. for Innovation & Trademark Accessibility Privacy Jobs Emergency Contact ASu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts