Question: 115 Question 37 (1 point) A stock has an average rate of return of 9.50% and a standard deviation of 8.60%. Which one of the

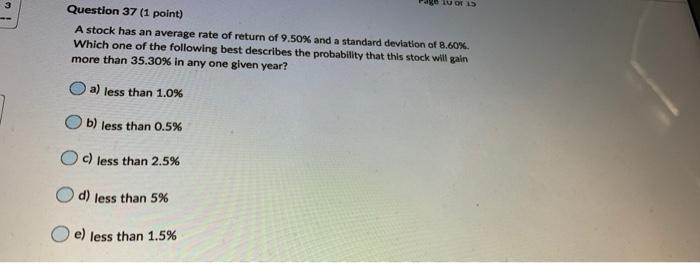

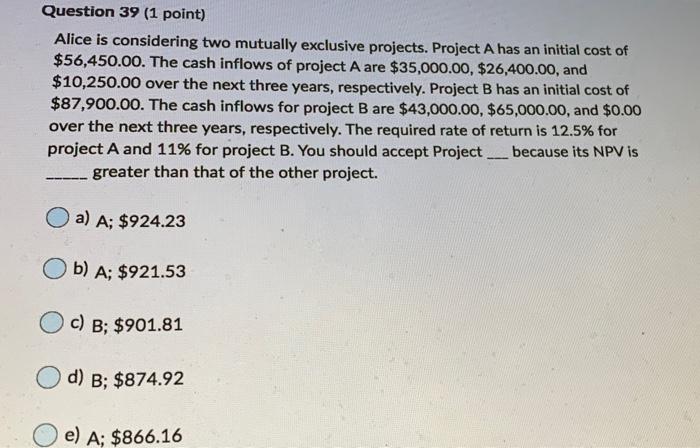

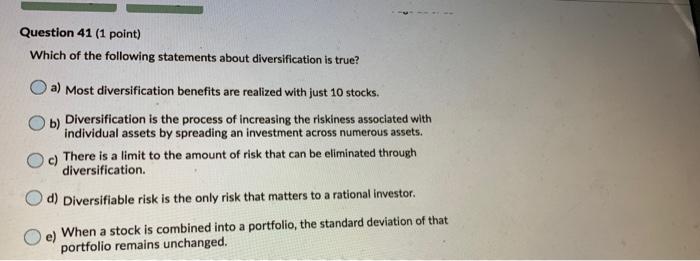

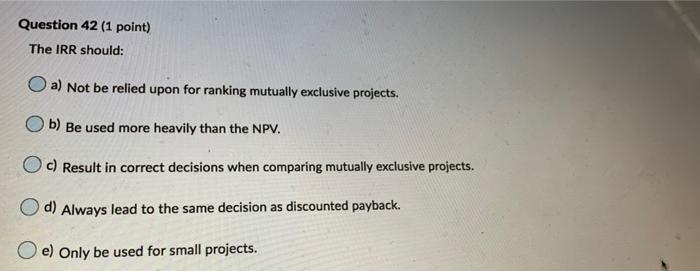

115 Question 37 (1 point) A stock has an average rate of return of 9.50% and a standard deviation of 8.60%. Which one of the following best describes the probability that this stock will gain more than 35.30% in any one given year? a) less than 1.0% b) less than 0.5% c) less than 2.5% d) less than 5% e) less than 1.5% Question 39 (1 point) Alice is considering two mutually exclusive projects. Project A has an initial cost of $56,450.00. The cash inflows of project A are $35,000.00, $26,400.00, and $10,250.00 over the next three years, respectively. Project B has an initial cost of $87,900.00. The cash inflows for project B are $43,000.00, $65,000.00, and $0.00 over the next three years, respectively. The required rate of return is 12.5% for project A and 11% for project B. You should accept Project because its NPV is greater than that of the other project. - a) A; $924.23 b) A; $921.53 c) B: $901.81 d) B; $874.92 e) A; $866.16 Question 41 (1 point) Which of the following statements about diversification is true? a) Most diversification benefits are realized with just 10 stocks. b) Diversification is the process of increasing the riskiness associated with individual assets by spreading an investment across numerous assets. There is a limit to the amount of risk that can be eliminated through diversification. d) Diversifiable risk is the only risk that matters to a rational investor. e) When a stock is combined into a portfolio, the standard deviation of that portfolio remains unchanged. Question 42 (1 point) The IRR should: a) Not be relied upon for ranking mutually exclusive projects. b) Be used more heavily than the NPV. c) Result in correct decisions when comparing mutually exclusive projects. d) Always lead to the same decision as discounted payback. e) Only be used for small projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts