Question: 11:56 3+ U ... DO NOT TURN OVER THIS PAGE UNTIL INSTRUCTED TO DO SO. (Student ID: Full Name: CONFIDENTIAL 202109/ MAT317 QUESTION 1 (25

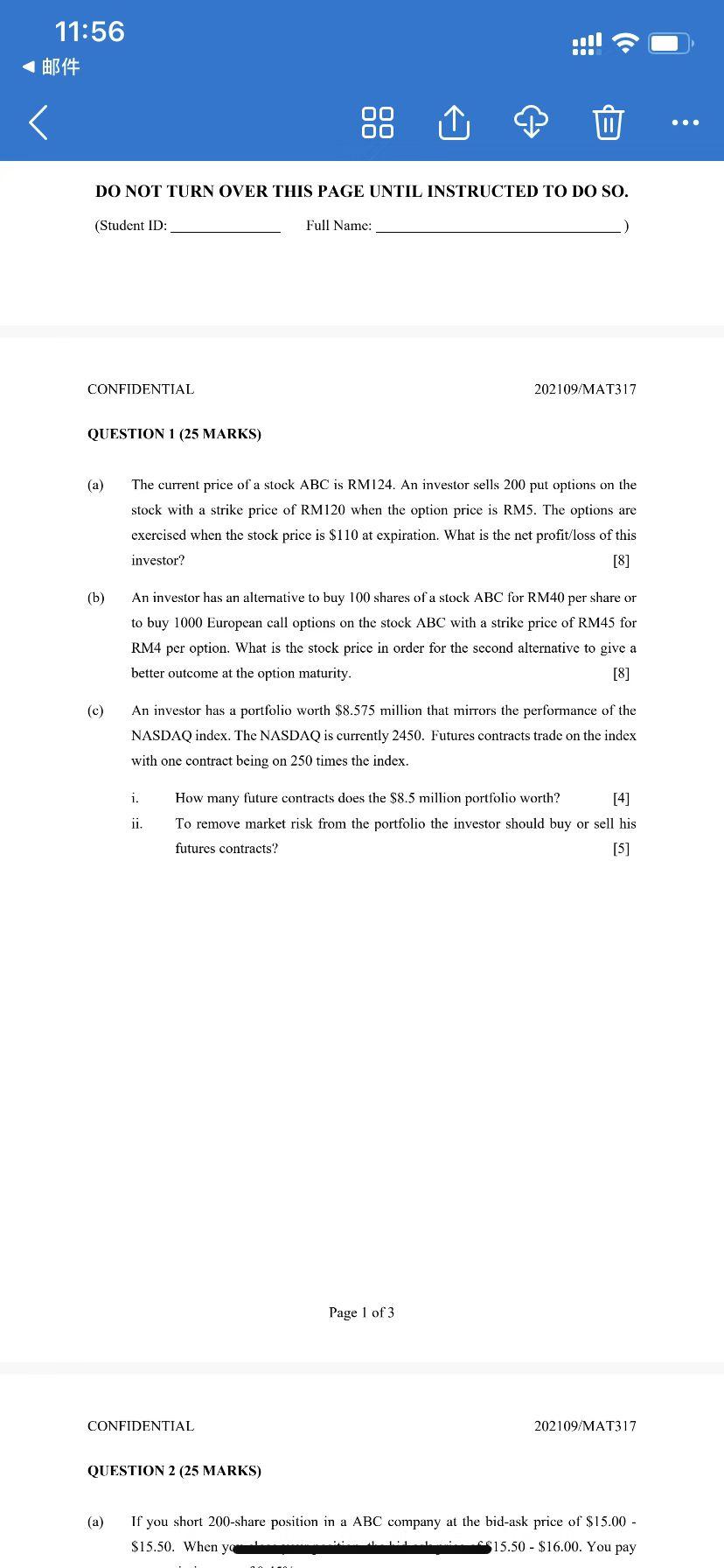

11:56 3+ U ... DO NOT TURN OVER THIS PAGE UNTIL INSTRUCTED TO DO SO. (Student ID: Full Name: CONFIDENTIAL 202109/ MAT317 QUESTION 1 (25 MARKS) (a) The current price of a stock ABC is RM124. An investor sells 200 put options on the stock with a strike price of RM120 when the option price is RM5. The options are exercised when the stock price is $110 at expiration. What is the net profit/loss of this investor? [8] (b) An investor has an alternative to buy 100 shares of a stock ABC for RM40 per share or to buy 1000 European call options on the stock ABC with a strike price of RM45 for RM4 per option. What is the stock price in order for the second alternative to give a better outcome at the option maturity. [8] (c) An investor has a portfolio worth $8.575 million that mirrors the performance of the NASDAQ index. The NASDAQ is currently 2450. Futures contracts trade on the index with one contract being on 250 times the index. i. ii, How many future contracts does the $8.5 million portfolio worth? [4] To remove market risk from the portfolio the investor should buy or sell his futures contracts? [5] Page 1 of 3 CONFIDENTIAL 202109/MAT317 QUESTION 2 (25 MARKS) (a) If you short 200-share position in a ABC company at the bid-ask price of $15.00 - $15.50. When yo $15.50 - $16.00. You pay NULL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts