Question: ()11.Interest-sensitive gap techniques do not consider the impact of changing interest rates on stockholders' equity. ( )12.Off-balance-sheet items for a bank are fee generating transactions

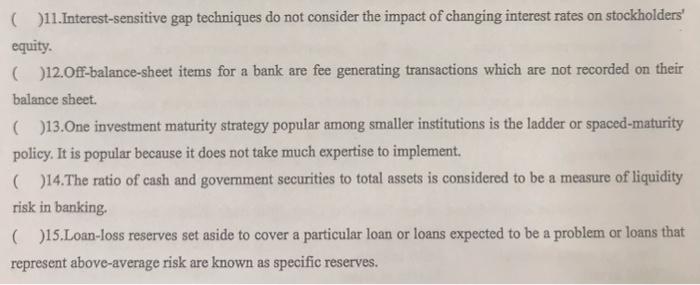

()11.Interest-sensitive gap techniques do not consider the impact of changing interest rates on stockholders' equity. ( )12.Off-balance-sheet items for a bank are fee generating transactions which are not recorded on their balance sheet. ( )13.One investment maturity strategy popular among smaller institutions is the ladder or spaced-maturity policy. It is popular because it does not take much expertise to implement. ( )14. The ratio of cash and government securities to total assets is considered to be a measure of liquidity risk in banking 15.Loan-loss reserves set aside to cover a particular loan or loans expected to be a problem or loans that represent above-average risk are known as specific reserves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts