Question: 12 13 A portfolio with a 20% standard deviation generated a return of 20% last year when T-bills were paying 7.0%. This portfolio had a

12

13

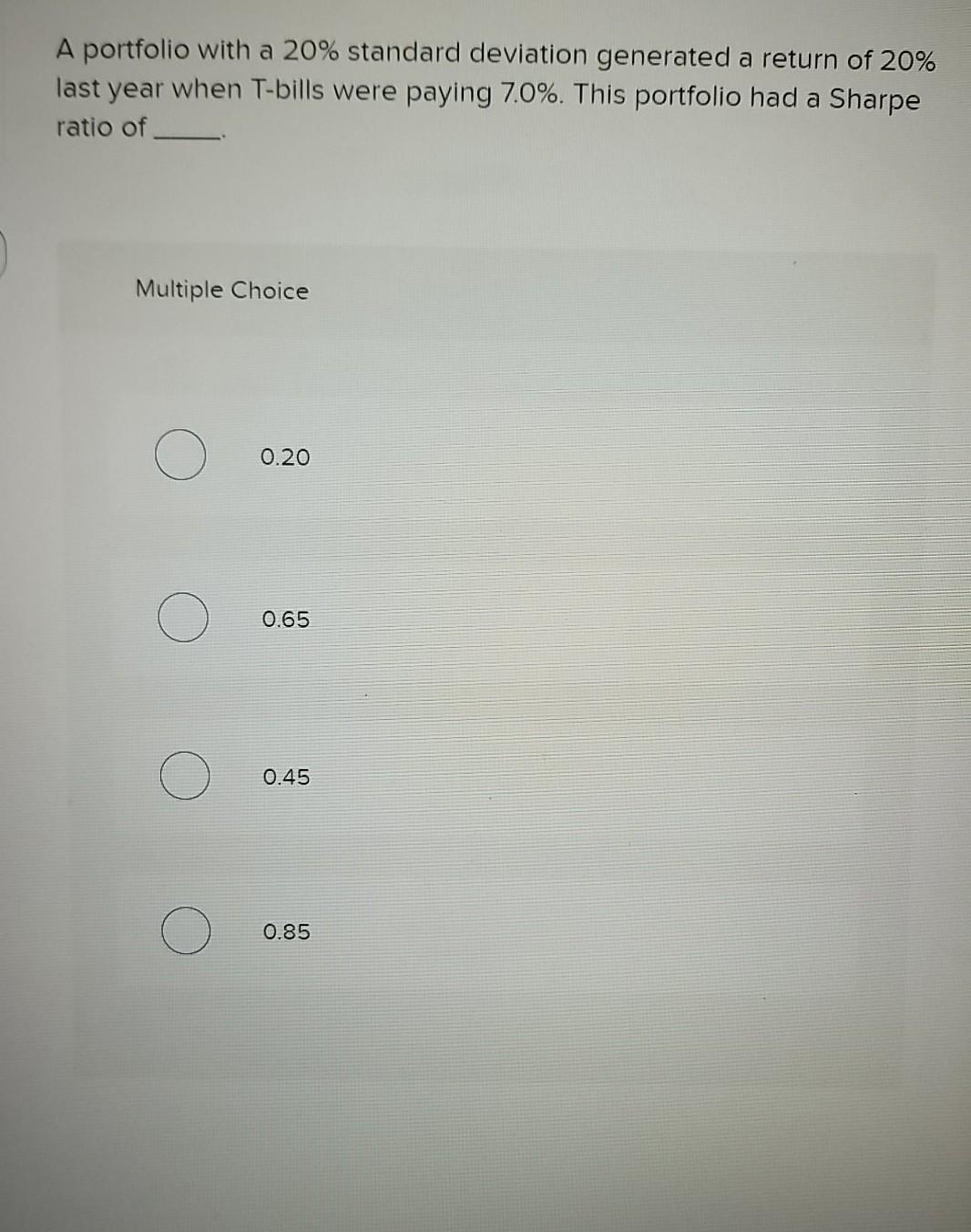

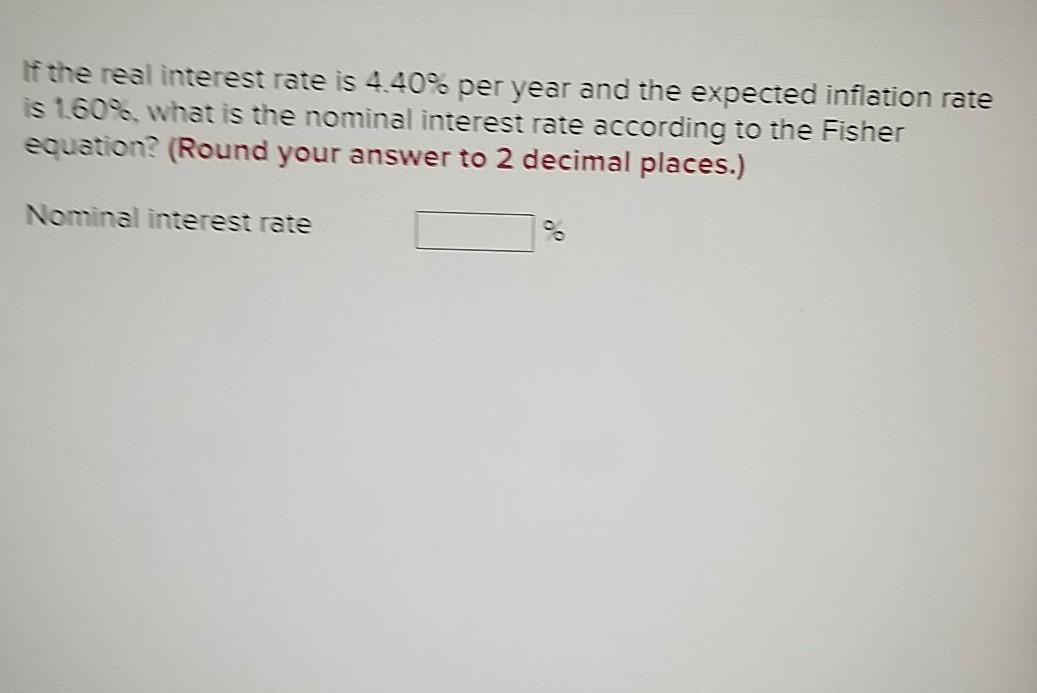

A portfolio with a 20% standard deviation generated a return of 20% last year when T-bills were paying 7.0%. This portfolio had a Sharpe ratio of Multiple Choice 0.20 0.65 0.45 0.85 If the real interest rate is 4.40% per year and the expected inflation rate is 160%, what is the nominal interest rate according to the Fisher equation? (Round your answer to 2 decimal places.) Nominal interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts