Question: 12 & 13 (Support Department Cost Allocation - Direct Method) Charlie's Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on). Production

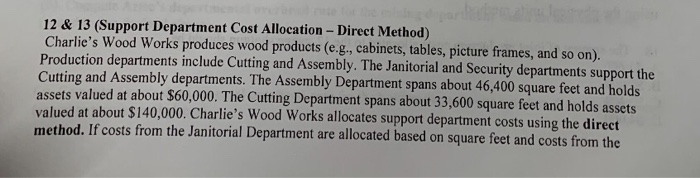

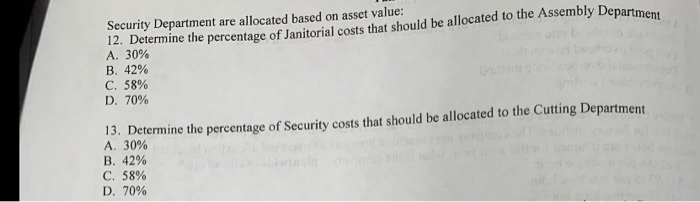

12 & 13 (Support Department Cost Allocation - Direct Method) Charlie's Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on). Production departments include Cutting and Assembly. The Janitorial and Security departments support the Cutting and Assembly departments. The Assembly Department spans about 46,400 square feet and holds assets valued at about $60,000. The Cutting Department spans about 33,600 square feet and holds assets valued at about $140,000. Charlie's Wood Works allocates support department costs using the direct method. If costs from the Janitorial Department are allocated based on square feet and costs from the Security Department are allocated based on asset value: 12. Determine the percentage of Ianitorial caste that should be allocated to the Assembly Departma A. 30% B. 42% C. 58% D. 70% 13. Determine the percentage of Security costs that should be allocated to the Cutting Department A. 30% B. 42% C. 58% D. 70%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts