Question: 12 & 19 please Question 11 1 pts Your property tax bill of $4,000 is due in 7 months. How much do you have to

12 & 19 please

12 & 19 please

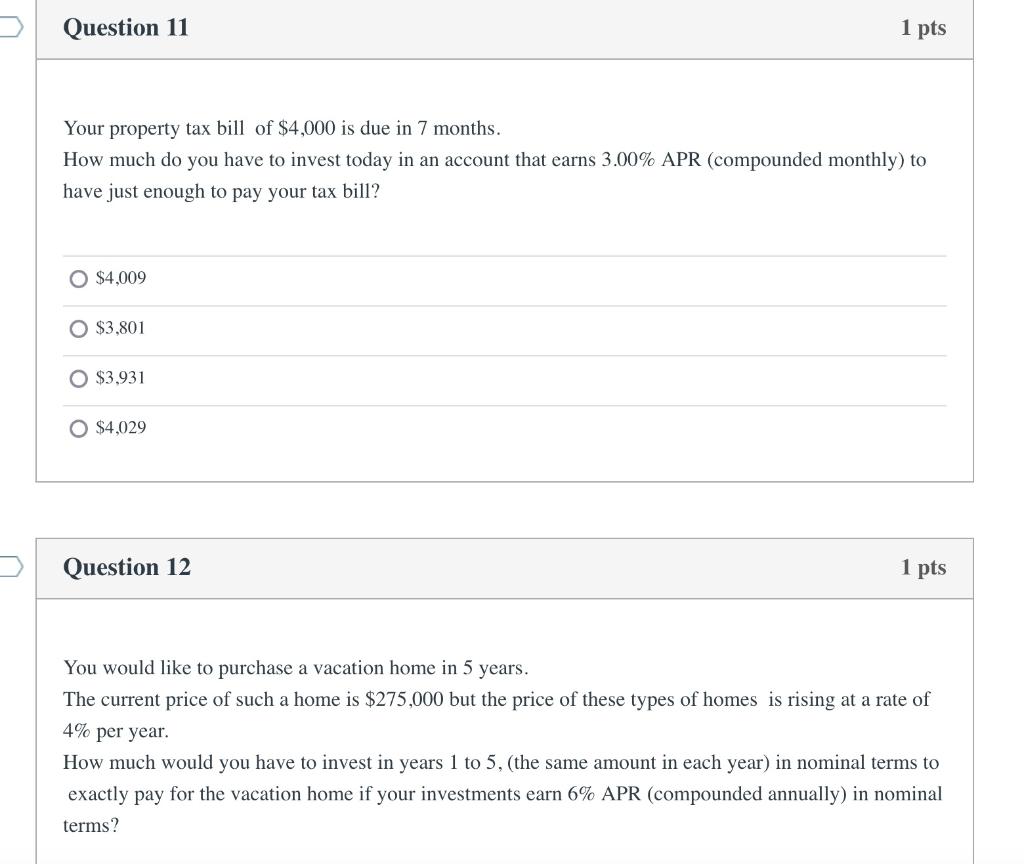

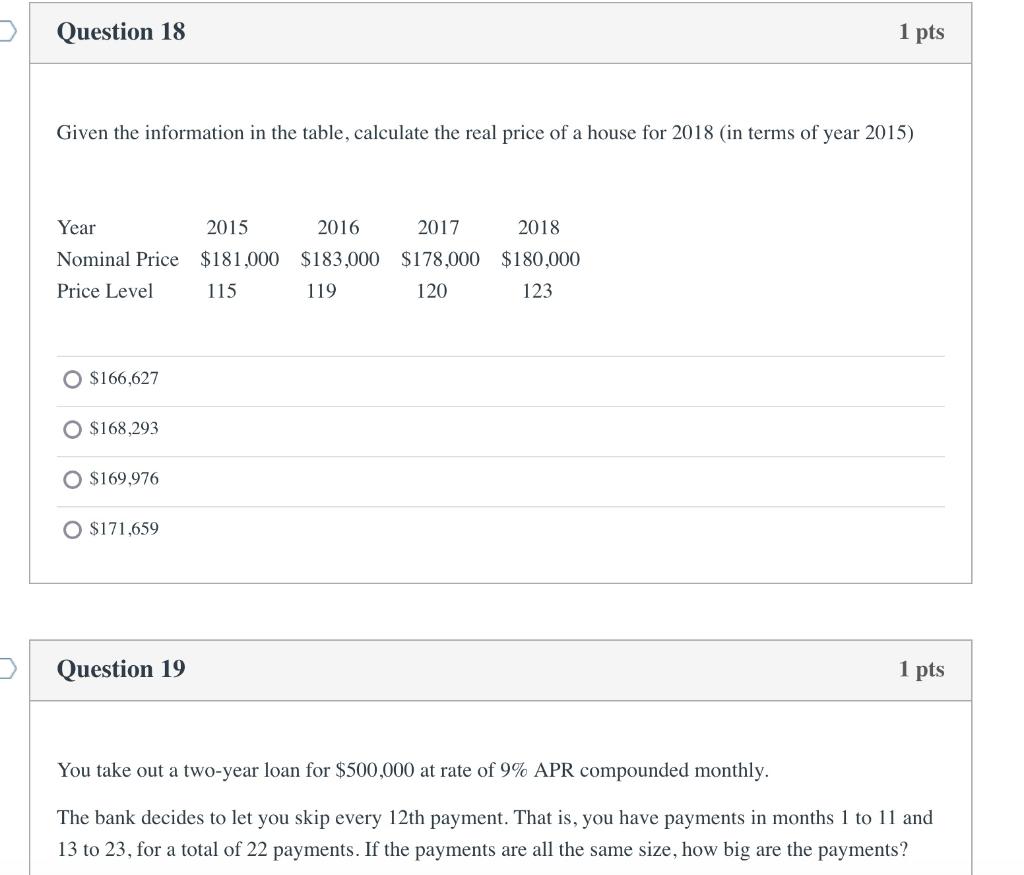

Question 11 1 pts Your property tax bill of $4,000 is due in 7 months. How much do you have to invest today in an account that earns 3.00% APR (compounded monthly) to have just enough to pay your tax bill? O $4,009 $3,801 O $3,931 O $4.029 Question 12 1 pts You would like to purchase a vacation home in 5 years. The current price of such a home is $275,000 but the price of these types of homes is rising at a rate of 4% per year. How much would you have to invest in years 1 to 5, (the same amount in each year) in nominal terms to exactly pay for the vacation home if your investments earn 6% APR (compounded annually) in nominal terms? Question 18 1 pts Given the information in the table, calculate the real price of a house for 2018 (in terms of year 2015) Year 2015 2016 2017 2018 Nominal Price $181,000 $183,000 $178,000 $180,000 Price Level 115 119 120 123 O $166,627 O $168,293 $169,976 O $171,659 Question 19 1 pts You take out a two-year loan for $500,000 at rate of 9% APR compounded monthly. The bank decides to let you skip every 12th payment. That is, you have payments in months 1 to 11 and 13 to 23, for a total of 22 payments. If the payments are all the same size, how big are the payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts