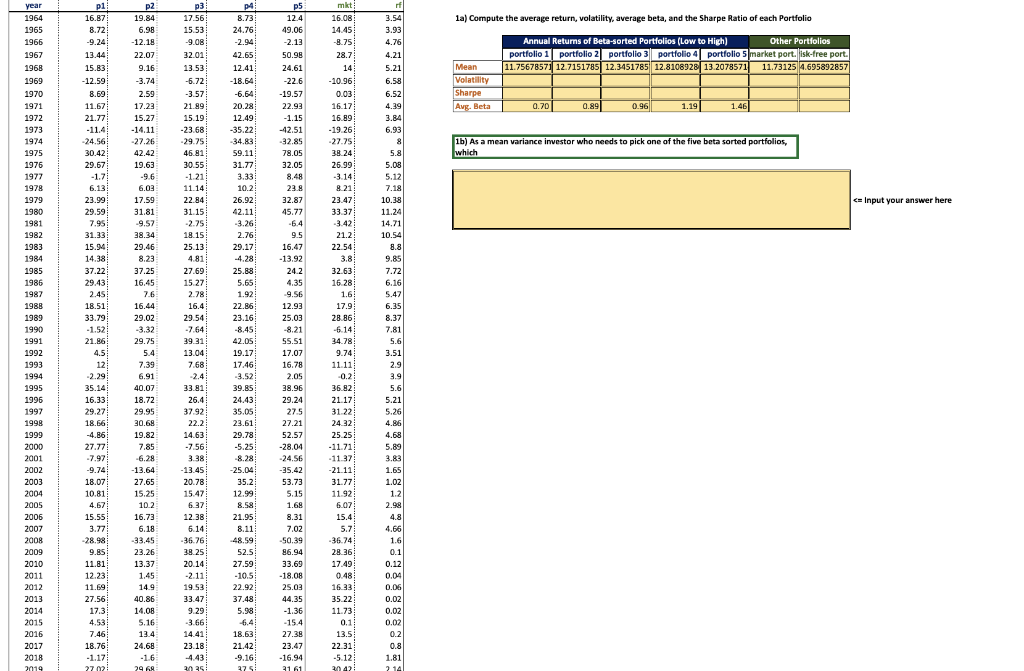

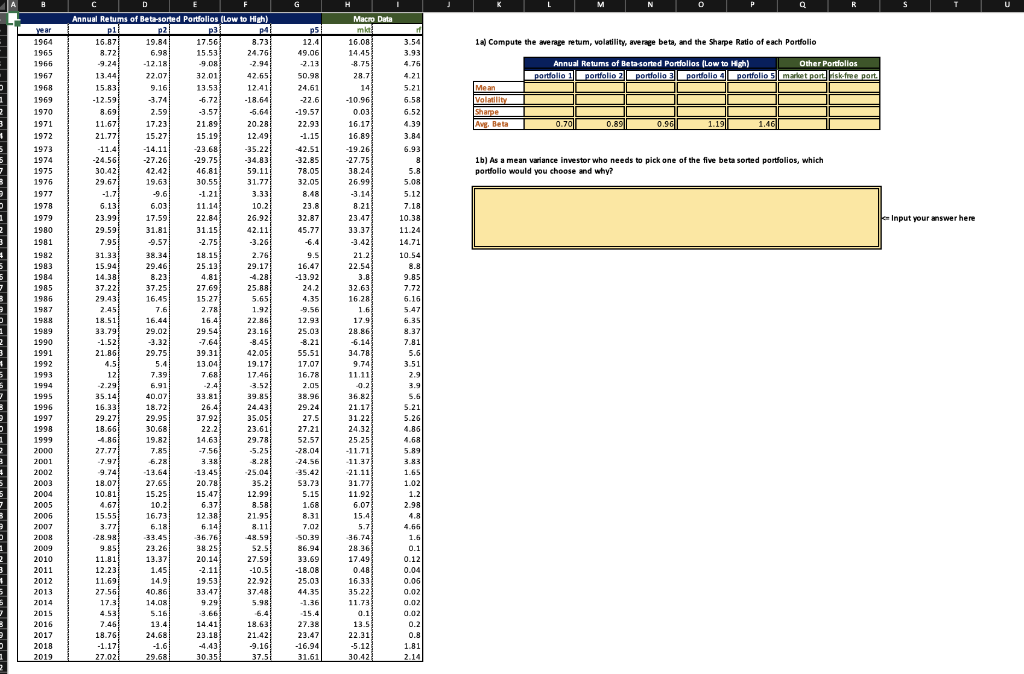

Question: & 12 4 mimo la) Compute the average return, volatility, average beta, and the Sharpe Ratio of each Portfolio Annual Returns of Bete-sorted Portfolio Portfolio

& 12 4 mimo la) Compute the average return, volatility, average beta, and the Sharpe Ratio of each Portfolio Annual Returns of Bete-sorted Portfolio Portfolio Portfolio 2 portfolio 3 portfolio 4 | Mean 1.1.75678571 Sharpe Avg. Beta 0.70 z 16) As a mean variance investor who needs to pick one of the five beta sorted portfolios, NS C= Input your answer here AN 2 NERAS as NM FU i wifi &&&&&&&&&& SaaS * OS 41 * Ons Pur 2 D M Q U 1a) Compute the average retum, volatility, average beta, and the Sharpe Ratio of each Portfolio Annual Retums of Beta-sorted Portfolios (Low to High) Other Portfolios portfolio 1 portfolio 2 portfolio 3 portfolio 4 portfolio 5 market port risk-free port 1 2) Mean Volatility Sharpe Avg. Beta 0.70 0.89 0.96|| 1.191 1.46 1b) As a mean variance investor who needs to pick one of the five beta sorted portfolios, which portfolio would you choose and why? - Input your answer here Year 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1975 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2005 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Annual Retums of Beta-sorted Portfolios (Low to High) p1 p2 p3 p4 16.87 19.84 17.56 8.73 8.72 6.98 15.53 24.76 -9.24 -12.18 -9.08 -2.941 13.44 22.07 32.01 42.65 15.83 9.16 13.53 12.41 -12.59 -3.74 -6.72 -18.54 8.69 2.59 -3.57 -5.64 11.67 17.23 21.89 20.28 21.77 15.27 15.191 12.49 -11.4 - 14.11 -23.68 -35.22 -24.56 -27.26 -29.75 -34.83 30.42 42.42 46.81 59.11 29.67 19.63 30.55 31.771 -1.7 -9.6 -1.21 3.33 6.13 6.03 11.14 10.21 23.99 17.59 22.84 26.92 29.59 31.81 31.15 42.11 7.95 9.57 -2.75 -3.26 31.33 38.34 18.15) 2.76 15.94 29.46 25.13 29.17 14.38 8.23 4.81 4.28 37.22 37.25 27.69 25.88 29.43 16.45 15.271 5.65 2.45 7.6 2.78 1.92 18.51 16.44 16.41 22.86 33.79 29.02 29.54 23.16 -1.52 -3.32 -7.64 -8.45 21.86 29.75 39.31 42.05 4.51 5.4 13.04 19.17 121 7.39 7.68 17.45 -2.29 6.91 -2.4 -3.52 35.14 40.07 33.81 39.85 16.33 18.72 26.4 24.43 29.27 29.95 37.92 35.05 18.65 30.68 22.2 23.61 19.82 14.63 29.78 27.77 7.85 -7.56 -5.25 -7.97 6.28 3.38 3.28 9.74 13.64 -13.451 25.04 18.07 27.65 20.78 35.2 10.81 15.25 15.47 12.99 4.67 10.21 6.37] 8.581 15.55 16.73 12.38 21.95 3.77 6.18 6.14 8.11 28.98 33.45 36.76 48.59 9.85 23.26 38.251 52.5 11.81 13.37 20.14 27.59 12.23 1.45 -2.11 -10.5 11.691 14.9 19.53 22.92 27.55 40.86 33.47 37.481 17.31 14.08 9.29 5.98 4.53 5.16 3.66) 6.4 7.46 13.4 14.41 18.63 18.76 24.68 23.18 21.42 -1.17 -1.6 -9.16 27.02! 29.68 30.35 37.51 p51 12.4 49.06 -2.13 50.98 24.61 -22.6 -19.57 22.93 -1.15 42.51 -32.85 78.05 32.05 8.48 23.8 32.87 45.77 -6.4 9.5 16.47 -13.92 24,2 4.35 -9.56 12.93 25.03 -8.21 55.51 17.07 16.78 2.05 38.96 29.24 27.5 27.21 52.57 -28.04 24.56 35.42 S3.73 5.15 1.68 8.31 7.02 50.39 86.94 33.69 -18.08 25.03 44.35 -1.36 15.4 27.381 23.47 -16.94 31.61 Macro Data ma 16.08 14.45 -8.75 28.7 14 -10.96 0.03 16.17 16.89 -19.26 -27.75 38.24 26.99 -3.14 8.21 23.47 33.37 -3.42 21.2 22.54 3.8 32.63 16.28 1.6 17.9 28.86 -6.14 34.78 9.74 11.11 -0.2 36.82 21.17 31.22 24.32 25.25 -11.71 -11.37 21.11 31.77 11.92 6.07 15.4 5.7 36.74 28.36 17.49 0.48 16.33 35.22 11.73 0.1 13.5 22.31 -5.12 30.12 3.54 3.93 4.76 4.21 5.21 5.58 6.52 4.39 3.84 6.93 8 5.8 5.08 5.12 7.18 10.38 11.24 14.71 10.54 8.8 9.85 7.72 5.15 5.47 6.35 9.37 7.81 5.6 3.51 2.9 3.9 5.6 5.21 5.26 4,850 4.68 5.89 3.83 1.65 1.02 1.2 2.98 4.8 . 4.66 1.6 0.1 0.12 0.04 0.05 0.02 0.02 0.02 0.2 0.8 1.81 2.14 -4.85 & 12 4 mimo la) Compute the average return, volatility, average beta, and the Sharpe Ratio of each Portfolio Annual Returns of Bete-sorted Portfolio Portfolio Portfolio 2 portfolio 3 portfolio 4 | Mean 1.1.75678571 Sharpe Avg. Beta 0.70 z 16) As a mean variance investor who needs to pick one of the five beta sorted portfolios, NS C= Input your answer here AN 2 NERAS as NM FU i wifi &&&&&&&&&& SaaS * OS 41 * Ons Pur 2 D M Q U 1a) Compute the average retum, volatility, average beta, and the Sharpe Ratio of each Portfolio Annual Retums of Beta-sorted Portfolios (Low to High) Other Portfolios portfolio 1 portfolio 2 portfolio 3 portfolio 4 portfolio 5 market port risk-free port 1 2) Mean Volatility Sharpe Avg. Beta 0.70 0.89 0.96|| 1.191 1.46 1b) As a mean variance investor who needs to pick one of the five beta sorted portfolios, which portfolio would you choose and why? - Input your answer here Year 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1975 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2005 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Annual Retums of Beta-sorted Portfolios (Low to High) p1 p2 p3 p4 16.87 19.84 17.56 8.73 8.72 6.98 15.53 24.76 -9.24 -12.18 -9.08 -2.941 13.44 22.07 32.01 42.65 15.83 9.16 13.53 12.41 -12.59 -3.74 -6.72 -18.54 8.69 2.59 -3.57 -5.64 11.67 17.23 21.89 20.28 21.77 15.27 15.191 12.49 -11.4 - 14.11 -23.68 -35.22 -24.56 -27.26 -29.75 -34.83 30.42 42.42 46.81 59.11 29.67 19.63 30.55 31.771 -1.7 -9.6 -1.21 3.33 6.13 6.03 11.14 10.21 23.99 17.59 22.84 26.92 29.59 31.81 31.15 42.11 7.95 9.57 -2.75 -3.26 31.33 38.34 18.15) 2.76 15.94 29.46 25.13 29.17 14.38 8.23 4.81 4.28 37.22 37.25 27.69 25.88 29.43 16.45 15.271 5.65 2.45 7.6 2.78 1.92 18.51 16.44 16.41 22.86 33.79 29.02 29.54 23.16 -1.52 -3.32 -7.64 -8.45 21.86 29.75 39.31 42.05 4.51 5.4 13.04 19.17 121 7.39 7.68 17.45 -2.29 6.91 -2.4 -3.52 35.14 40.07 33.81 39.85 16.33 18.72 26.4 24.43 29.27 29.95 37.92 35.05 18.65 30.68 22.2 23.61 19.82 14.63 29.78 27.77 7.85 -7.56 -5.25 -7.97 6.28 3.38 3.28 9.74 13.64 -13.451 25.04 18.07 27.65 20.78 35.2 10.81 15.25 15.47 12.99 4.67 10.21 6.37] 8.581 15.55 16.73 12.38 21.95 3.77 6.18 6.14 8.11 28.98 33.45 36.76 48.59 9.85 23.26 38.251 52.5 11.81 13.37 20.14 27.59 12.23 1.45 -2.11 -10.5 11.691 14.9 19.53 22.92 27.55 40.86 33.47 37.481 17.31 14.08 9.29 5.98 4.53 5.16 3.66) 6.4 7.46 13.4 14.41 18.63 18.76 24.68 23.18 21.42 -1.17 -1.6 -9.16 27.02! 29.68 30.35 37.51 p51 12.4 49.06 -2.13 50.98 24.61 -22.6 -19.57 22.93 -1.15 42.51 -32.85 78.05 32.05 8.48 23.8 32.87 45.77 -6.4 9.5 16.47 -13.92 24,2 4.35 -9.56 12.93 25.03 -8.21 55.51 17.07 16.78 2.05 38.96 29.24 27.5 27.21 52.57 -28.04 24.56 35.42 S3.73 5.15 1.68 8.31 7.02 50.39 86.94 33.69 -18.08 25.03 44.35 -1.36 15.4 27.381 23.47 -16.94 31.61 Macro Data ma 16.08 14.45 -8.75 28.7 14 -10.96 0.03 16.17 16.89 -19.26 -27.75 38.24 26.99 -3.14 8.21 23.47 33.37 -3.42 21.2 22.54 3.8 32.63 16.28 1.6 17.9 28.86 -6.14 34.78 9.74 11.11 -0.2 36.82 21.17 31.22 24.32 25.25 -11.71 -11.37 21.11 31.77 11.92 6.07 15.4 5.7 36.74 28.36 17.49 0.48 16.33 35.22 11.73 0.1 13.5 22.31 -5.12 30.12 3.54 3.93 4.76 4.21 5.21 5.58 6.52 4.39 3.84 6.93 8 5.8 5.08 5.12 7.18 10.38 11.24 14.71 10.54 8.8 9.85 7.72 5.15 5.47 6.35 9.37 7.81 5.6 3.51 2.9 3.9 5.6 5.21 5.26 4,850 4.68 5.89 3.83 1.65 1.02 1.2 2.98 4.8 . 4.66 1.6 0.1 0.12 0.04 0.05 0.02 0.02 0.02 0.2 0.8 1.81 2.14 -4.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts