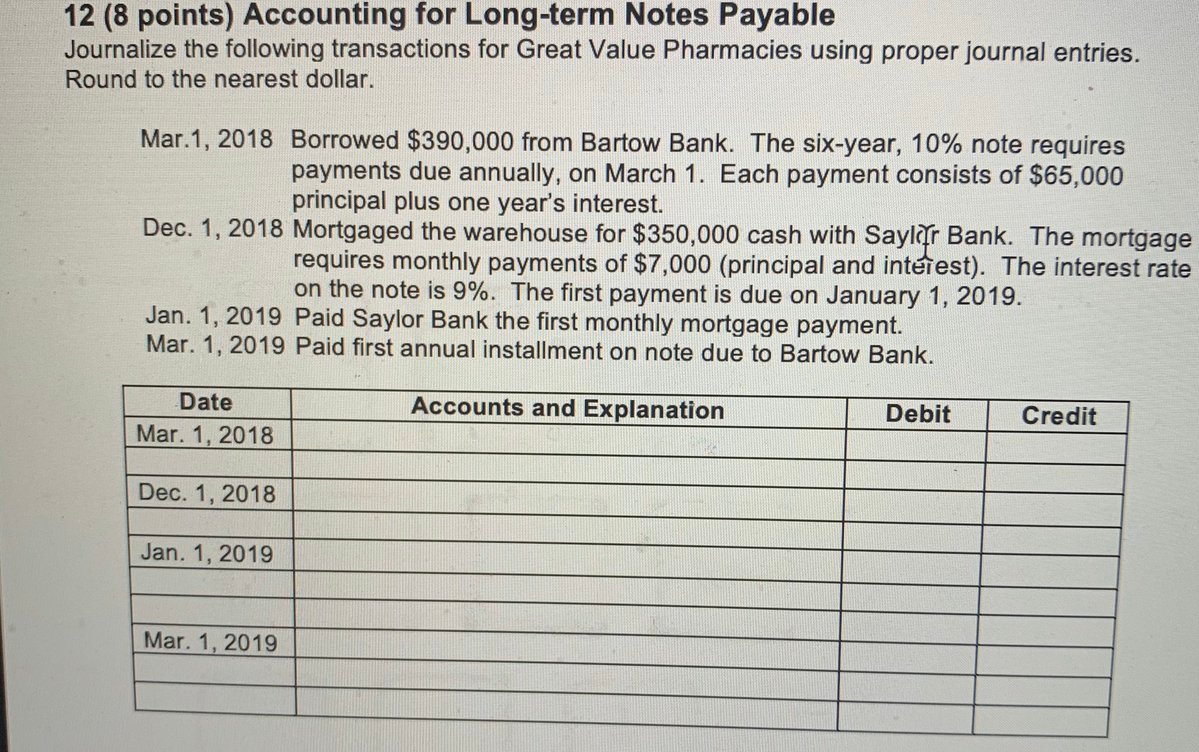

Question: 12 (8 points) Accounting for Long-term Notes Payable Journalize the following transactions for Great Value Pharmacies using proper journal entries. Round to the nearest dollar.

12 (8 points) Accounting for Long-term Notes Payable Journalize the following transactions for Great Value Pharmacies using proper journal entries. Round to the nearest dollar. Mar.1, 2018 Borrowed $390,000 from Bartow Bank. The six-year, 10% note requires payments due annually, on March 1. Each payment consists of $65,000 principal plus one year's interest. Dec. 1, 2018 Mortgaged the warehouse for $350,000 cash with Sayler Bank. The mortgage requires monthly payments of $7,000 (principal and interest). The interest rate on the note is 9%. The first payment is due on January 1, 2019. Jan. 1, 2019 Paid Saylor Bank the first monthly mortgage payment. Mar. 1, 2019 Paid first annual installment on note due to Bartow Bank. Accounts and Explanation Debit Credit Date Mar. 1, 2018 Dec. 1, 2018 | Jan. 1, 2019 Mar. 1, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts