Question: 12. a. What is a bond? List and explain three types of risk faced by investor when they purchase bonds. b. An investor, Encik Dodo,

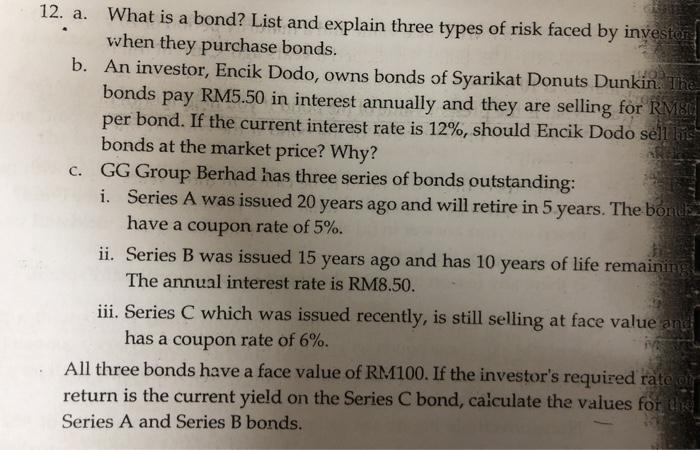

12. a. What is a bond? List and explain three types of risk faced by investor when they purchase bonds. b. An investor, Encik Dodo, owns bonds of Syarikat Donuts Dunkin. The bonds pay RM5.50 in interest annually and they are selling for RMS per bond. If the current interest rate is 12%, should Encik Dodo sell lines bonds at the market price? Why? c. GG Group Berhad has three series of bonds outstanding: i. Series A was issued 20 years ago and will retire in 5 years. The bonds have a coupon rate of 5%. ii. Series B was issued 15 years ago and has 10 years of life remaining The annual interest rate is RM8.50. iii. Series C which was issued recently, is still selling at face value and has a coupon rate of 6%. All three bonds have a face value of RM100. If the investor's required rate or return is the current yield on the Series C bond, calculate the values for the Series A and Series B bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts