Question: 12. Art is applying for CPP (Canada Pension Plan) at his current age 72. He has contributed the full amount to CPP over his life-long

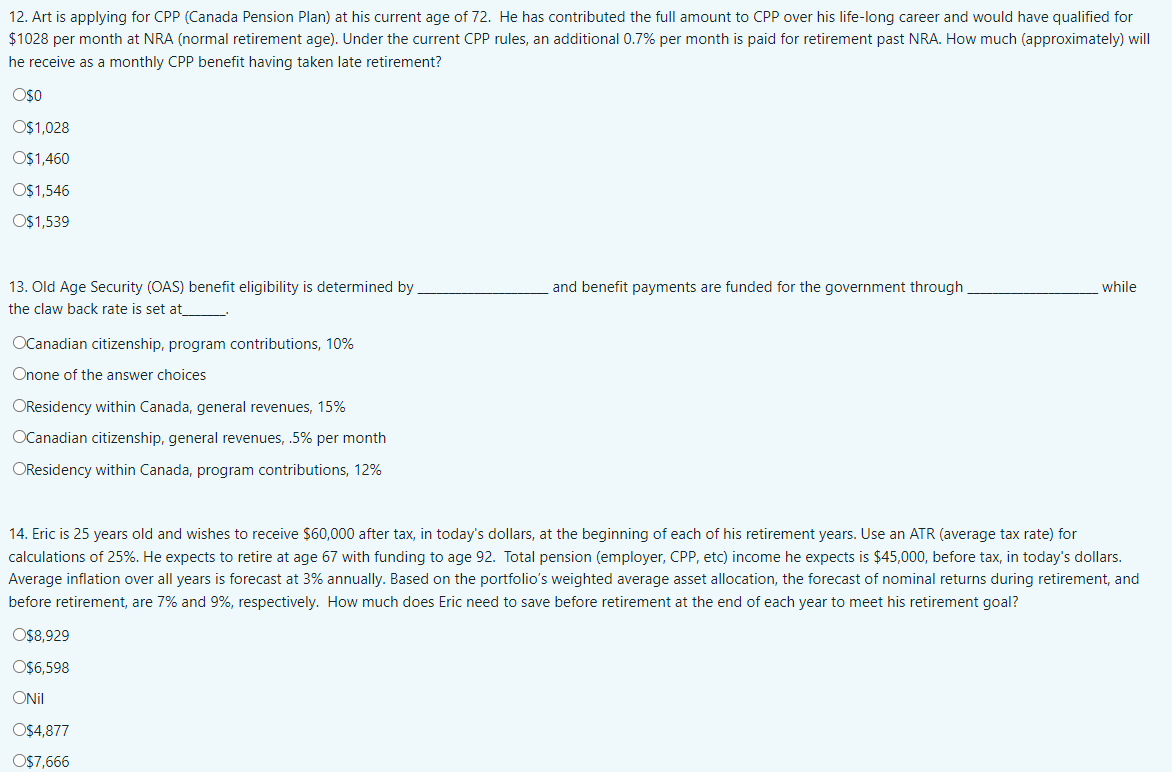

12. Art is applying for CPP (Canada Pension Plan) at his current age 72. He has contributed the full amount to CPP over his life-long career and would have qualified for $1028 per month at NRA (normal retirement age). Under the current CPP rules, an additional 0.7% per month is paid for retirement past NRA. How much (approximately) will he receive as a monthly CPP benefit having taken late retirement? OSO O$1,028 O$1,460 O$1,546 O$1,539 13. Old Age Security (OAS) benefit eligibility is determined by the claw back rate set at and benefit payments are funded for the government through while Canadian citizenship, program contributions, 10% Onone of the answer choices OResidency within Canada, general revenues, 15% Canadian citizenship, general revenues, .5% per month OResidency within Canada, program contributions, 12% 14. Eric is 25 years old and wishes to receive $60,000 after tax, in today's dollars, at the beginning of each of his retirement years. Use an ATR (average tax rate) for calculations of 25%. He expects to retire at age 67 with funding to age 92. Total pension (employer, CPP, etc) income he expects is $45,000, before tax, in today's dollars. Average inflation over all years is forecast at 3% annually. Based on the portfolio's weighted average asset allocation, the forecast of nominal returns during retirement, and before retirement, are 7% and 9%, respectively. How much does Eric need to save before retirement at the end of each year to meet his retirement goal? $8,929 O$6,598 ONII O$4,877 O$7,666 12. Art is applying for CPP (Canada Pension Plan) at his current age 72. He has contributed the full amount to CPP over his life-long career and would have qualified for $1028 per month at NRA (normal retirement age). Under the current CPP rules, an additional 0.7% per month is paid for retirement past NRA. How much (approximately) will he receive as a monthly CPP benefit having taken late retirement? OSO O$1,028 O$1,460 O$1,546 O$1,539 13. Old Age Security (OAS) benefit eligibility is determined by the claw back rate set at and benefit payments are funded for the government through while Canadian citizenship, program contributions, 10% Onone of the answer choices OResidency within Canada, general revenues, 15% Canadian citizenship, general revenues, .5% per month OResidency within Canada, program contributions, 12% 14. Eric is 25 years old and wishes to receive $60,000 after tax, in today's dollars, at the beginning of each of his retirement years. Use an ATR (average tax rate) for calculations of 25%. He expects to retire at age 67 with funding to age 92. Total pension (employer, CPP, etc) income he expects is $45,000, before tax, in today's dollars. Average inflation over all years is forecast at 3% annually. Based on the portfolio's weighted average asset allocation, the forecast of nominal returns during retirement, and before retirement, are 7% and 9%, respectively. How much does Eric need to save before retirement at the end of each year to meet his retirement goal? $8,929 O$6,598 ONII O$4,877 O$7,666

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts