Question: 12. Below are returns for next year for two companies, Best Queen (BQ) and Super King(SK), in various scenarios. 1) Based on the formulas for

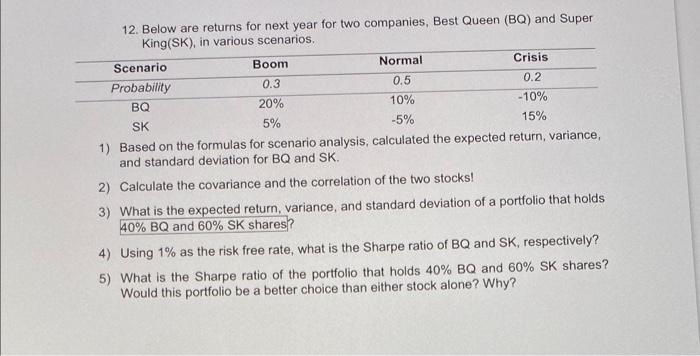

12. Below are returns for next year for two companies, Best Queen (BQ) and Super King(SK), in various scenarios. 1) Based on the formulas for scenario analysis, calculated the expected return, variance, and standard deviation for BQ and SK. 2) Calculate the covariance and the correlation of the two stocks! 3) What is the expected return, variance, and standard deviation of a portfolio that holds 40%BQ and 60% SK shares? 4) Using 1% as the risk free rate, what is the Sharpe ratio of BQ and SK, respectively? 5) What is the Sharpe ratio of the portfolio that holds 40%BQ and 60% SK shares? Would this portfolio be a better choice than either stock alone? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts