Question: 12 check internet similar problem but different values The West Island Publishing Company has a $60 million outstanding bond issue bearing a15% coupon Interest rate

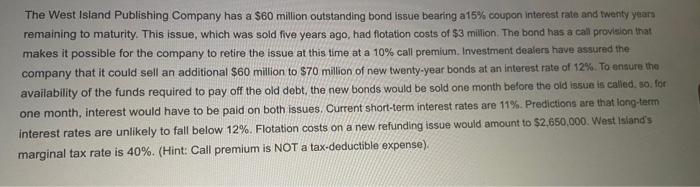

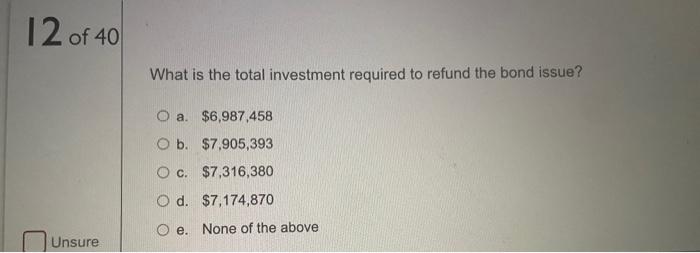

The West Island Publishing Company has a $60 million outstanding bond issue bearing a15% coupon Interest rate and twenty years remaining to maturity. This issue, which was sold five years ago, had flotation costs of $3 million. The bond has a call provision that makes it possible for the company to retire the issue at this time at a 10% call premium. Investment dealers have assured the company that it could sell an additional $60 million to $70 million of new twenty-year bonds at an interest rate of 12%. To ensure the availability of the funds required to pay off the old debt, the new bonds would be sold one month before the old issue is called, so for one month, interest would have to be paid on both issues. Current short-term interest rates are 11%. Predictions are that long-term interest rates are unlikely to fall below 12%. Flotation costs on a new refunding issue would amount to $2,650,000. West Island's marginal tax rate is 40%. (Hint: Call premium is NOT a tax-deductible expense). 12 of 40 What is the total investment required to refund the bond issue? O a. $6,987.458 O b. $7,905,393 O c. $7,316,380 O d. $7,174,870 O e. None of the above Unsure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts