Question: 12. Develop the formula for FVOA, with regular payment R, annual interest rater compounded k times per year, and t years. (Note that typically the

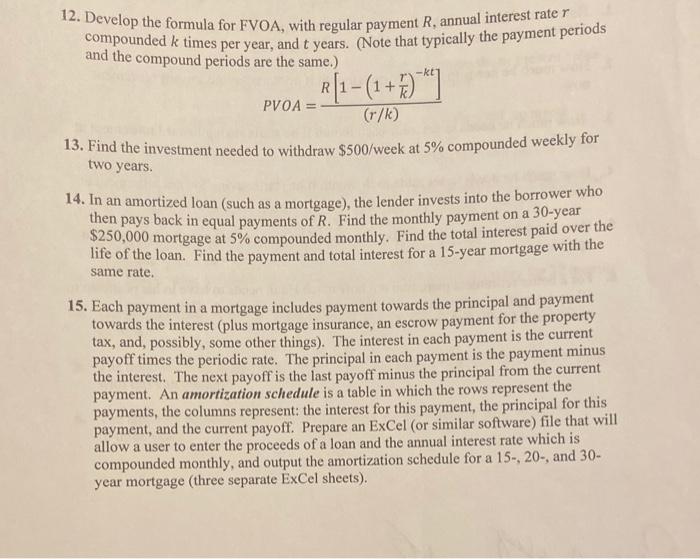

12. Develop the formula for FVOA, with regular payment R, annual interest rater compounded k times per year, and t years. (Note that typically the payment periods and the compound periods are the same.) R[1-(1 + ) +7 PVOA = (r/k) 13. Find the investment needed to withdraw $500/week at 5% compounded weekly for two years. 14. In an amortized loan (such as a mortgage), the lender invests into the borrower who then pays back in equal payments of R. Find the monthly payment on a 30-year $250,000 mortgage at 5% compounded monthly. Find the total interest paid over the life of the loan. Find the payment and total interest for a 15-year mortgage with the same rate. 15. Each payment in a mortgage includes payment towards the principal and payment towards the interest (plus mortgage insurance, an escrow payment for the property tax, and, possibly, some other things). The interest in each payment is the current payoff times the periodic rate. The principal in each payment is the payment minus the interest. The next payoff is the last payoff minus the principal from the current payment. An amortization schedule is a table in which the rows represent the payments, the columns represent: the interest for this payment, the principal for this payment, and the current payoff. Prepare an ExCel (or similar software) file that will allow a user to enter the proceeds of a loan and the annual interest rate which is compounded monthly, and output the amortization schedule for a 15- 20-, and 30- year mortgage (three separate ExCel sheets)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts