Question: 12. Financial statement forecasting problem Name Financial statement forecasting answer sheet Income Statement: Suppose that you are forecasting the financial statements (income statement and balance

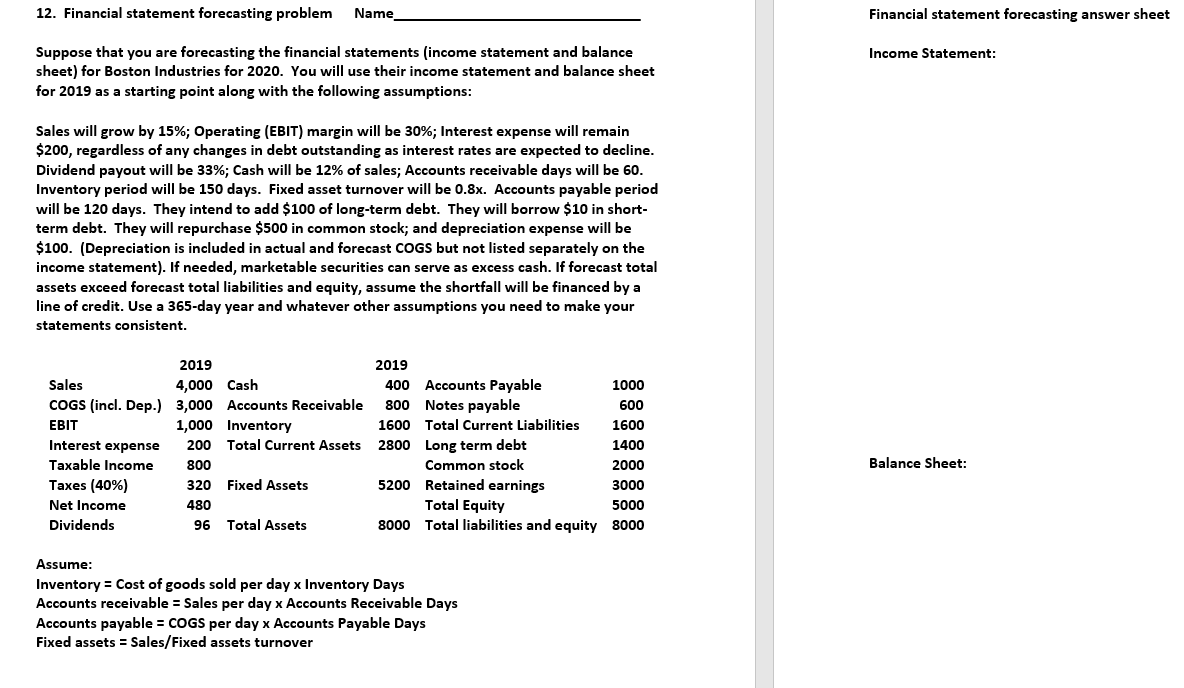

12. Financial statement forecasting problem Name Financial statement forecasting answer sheet Income Statement: Suppose that you are forecasting the financial statements (income statement and balance sheet) for Boston Industries for 2020. You will use their income statement and balance sheet for 2019 as a starting point along with the following assumptions: Sales will grow by 15%; Operating (EBIT) margin will be 30%; Interest expense will remain $200, regardless of any changes in debt outstanding as interest rates are expected to decline. Dividend payout will be 33%; Cash will be 12% of sales; Accounts receivable days will be 60. Inventory period will be 150 days. Fixed asset turnover will be 0.8x. Accounts payable period will be 120 days. They intend to add $100 of long-term debt. They will borrow $10 in short- term debt. They will repurchase $500 in common stock; and depreciation expense will be $100. (Depreciation is included in actual and forecast COGS but not listed separately on the income statement). If needed, marketable securities can serve as excess cash. If forecast total assets exceed forecast total liabilities and equity, assume the shortfall will be financed by a line of credit. Use a 365-day year and whatever other assumptions you need to make your statements consistent. 2019 Sales 4,000 Cash COGS (incl. Dep.) 3,000 Accounts Receivable EBIT 1,000 Inventory Interest expense 200 Total Current Assets Taxable Income 800 Taxes (40%) 320 Fixed Assets Net Income 480 Dividends 96 Total Assets 2019 400 Accounts Payable 1000 800 Notes payable 600 1600 Total Current Liabilities 1600 2800 Long term debt 1400 Common stock 2000 5200 Retained earnings 3000 Total Equity 5000 8000 Total liabilities and equity 8000 Balance Assume: Inventory = Cost of goods sold per day x Inventory Days Accounts receivable = Sales per day x Accounts Receivable Days Accounts payable = COGS per day x Accounts Payable Days Fixed assets = Sales/Fixed assets turnover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts