Question: 12 Homework Saved Help Save & Exit Submit Check my work mode: This shows what is correct or incorrect for the work you have completed

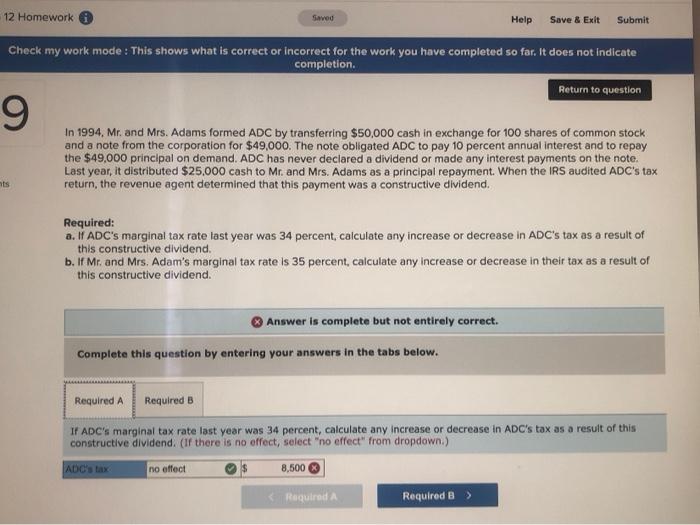

12 Homework Saved Help Save & Exit Submit Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to question 9 In 1994. Mr. and Mrs. Adams formed ADC by transferring $50,000 cash in exchange for 100 shares of common stock and a note from the corporation for $49,000. The note obligated ADC to pay 10 percent annual interest and to repay the $49.000 principal on demand. ADC has never declared a dividend or made any interest payments on the note. Last year, it distributed $25.000 cash to Mr. and Mrs. Adams as a principal repayment . When the IRS audited ADC's tax return, the revenue agent determined that this payment was a constructive dividend. ts Required: a. I ADC's marginal tax rate last year was 34 percent, calculate any increase or decrease in ADC's tax as a result of this constructive dividend. b. If Mr. and Mrs. Adam's marginal tax rate is 35 percent, calculate any increase or decrease in their tax as a result of this constructive dividend. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B If ADC's marginal tax rate last year was 34 percent, calculate any increase or decrease in ADC's tax as a result of this constructive dividend. (If there is no offect, select "no effect" from dropdown.) ADC's tas no effect 8,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts