Question: 12. Market value ratios Ratios are mostly calculated based on the financial statements of a firm. However, another group of ratios, called market-based ratios, relate

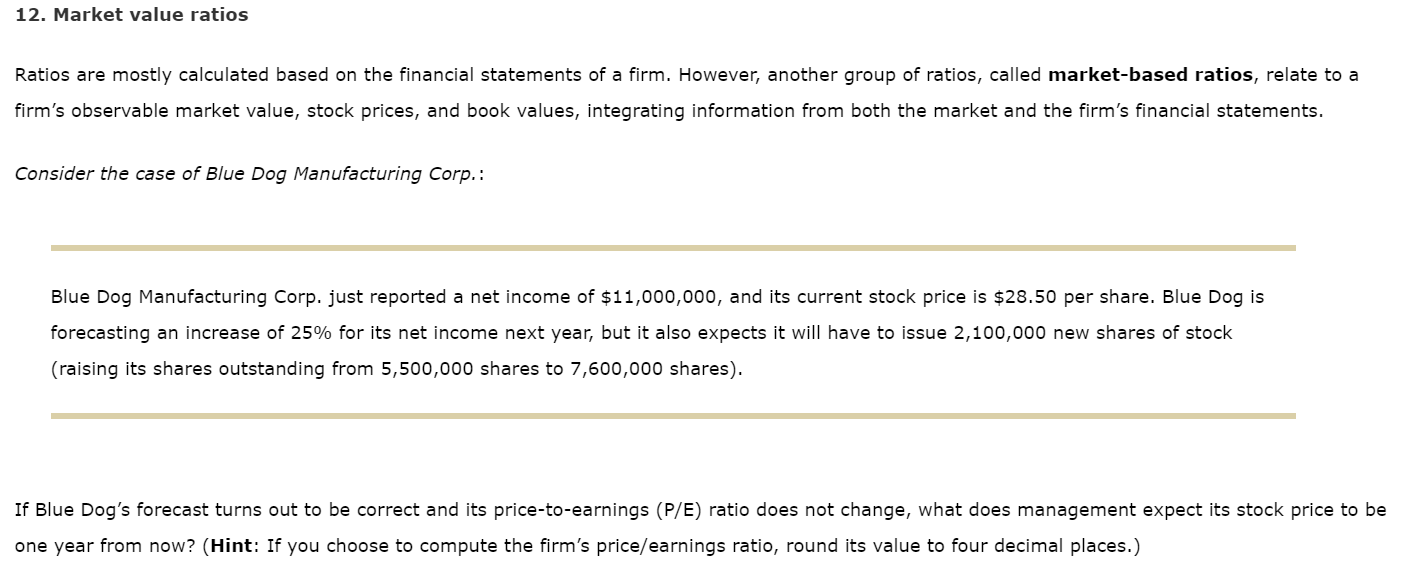

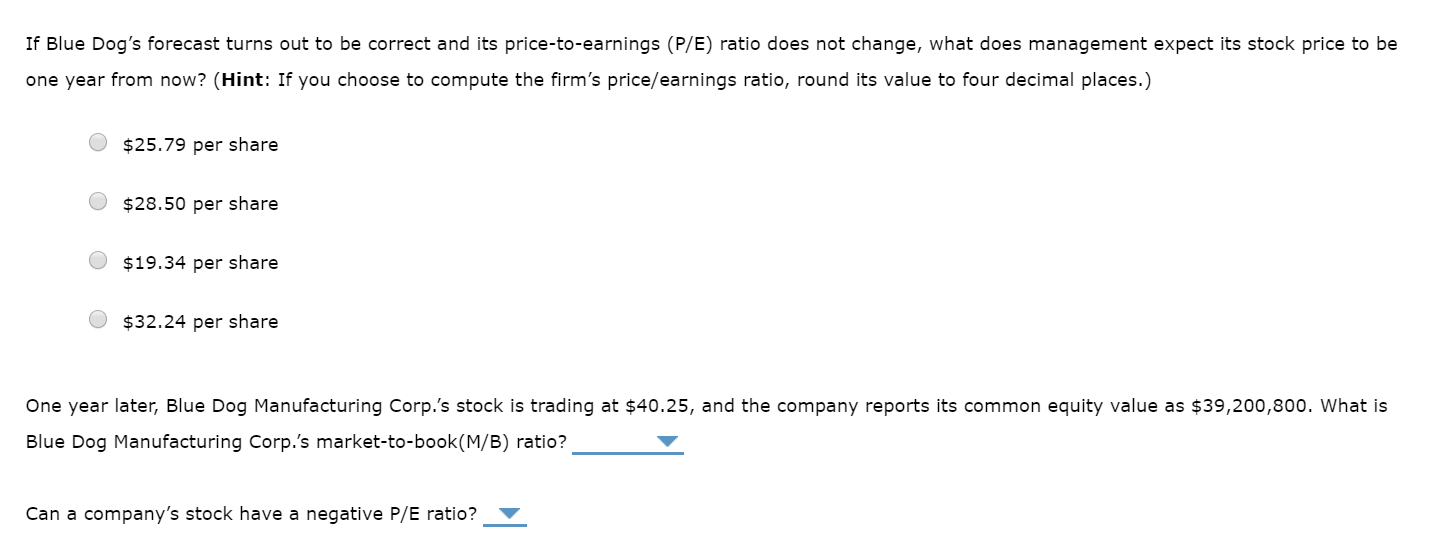

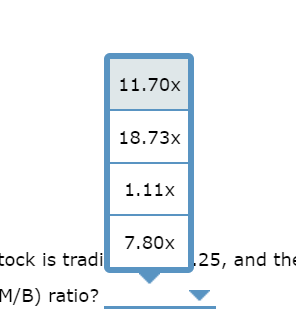

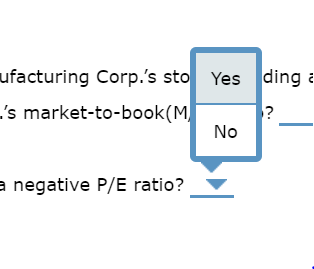

12. Market value ratios Ratios are mostly calculated based on the financial statements of a firm. However, another group of ratios, called market-based ratios, relate to a firm's observable market value, stock prices, and book values, integrating information from both the market and the firm's financial statements. Consider the case of Blue Dog Manufacturing Corp.: Blue Dog Manufacturing Corp. just reported a net income of $11,000,000, and its current stock price is $28.50 per share. Blue Dog is forecasting an increase of 25% for its net income next year, but it also expects it will have to issue 2,100,000 new shares of stock (raising its shares outstanding from 5,500,000 shares to 7,600,000 shares). If Blue Dog's forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does management expect its stock price to be one year from now? (Hint: If you choose to compute the firm's price/earnings ratio, round its value to four decimal places.) If Blue Dog's forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does management expect its stock price to be one year from now? (Hint: If you choose to compute the firm's price/earnings ratio, round its value to four decimal places.) O $25.79 per share O $28.50 per share O $19.34 per share O $32.24 per share One year later, Blue Dog Manufacturing Corp.'s stock is trading at $40.25, and the company reports its common equity value as $39,200,800. What is Blue Dog Manufacturing Corp.'s market-to-book(M/B) ratio? Can a company's stock have a negative P/E ratio? 11.70x 18.73x 1.11x 7.80x 25, and the tock is tradi M/B) ratio? Yes ding ufacturing Corp.'s sto 's market-to-book(M No a negative P/E ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts