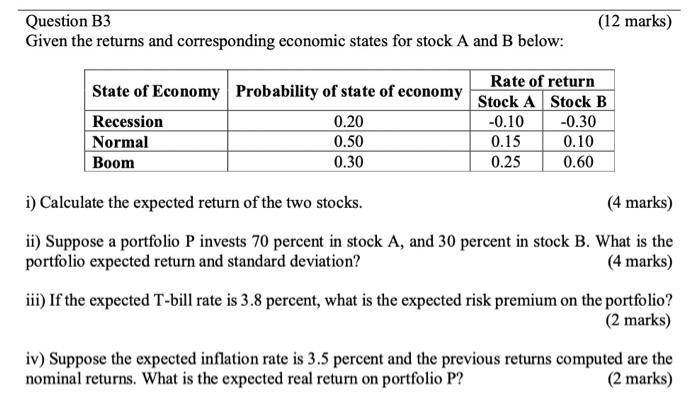

Question: (12 marks) Question B3 Given the returns and corresponding economic states for stock A and B below: State of Economy Probability of state of economy

(12 marks) Question B3 Given the returns and corresponding economic states for stock A and B below: State of Economy Probability of state of economy Recession 0.20 Normal 0.50 Boom 0.30 Rate of return Stock A Stock B -0.10 -0.30 0.15 0.10 0.25 0.60 i) Calculate the expected return of the two stocks. (4 marks) ii) Suppose a portfolio P invests 70 percent in stock A, and 30 percent in stock B. What is the portfolio expected return and standard deviation? (4 marks) iii) If the expected T-bill rate is 3.8 percent, what is the expected risk premium on the portfolio? (2 marks) iv) Suppose the expected inflation rate is 3.5 percent and the previous returns computed are the nominal returns. What is the expected real return on portfolio P? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts