Question: 12 multiple choice questions 9. Prepare the partial balance sheet at December 31, 2019, and show the net realizable value of accounts receivable assuming %

12 multiple choice questions

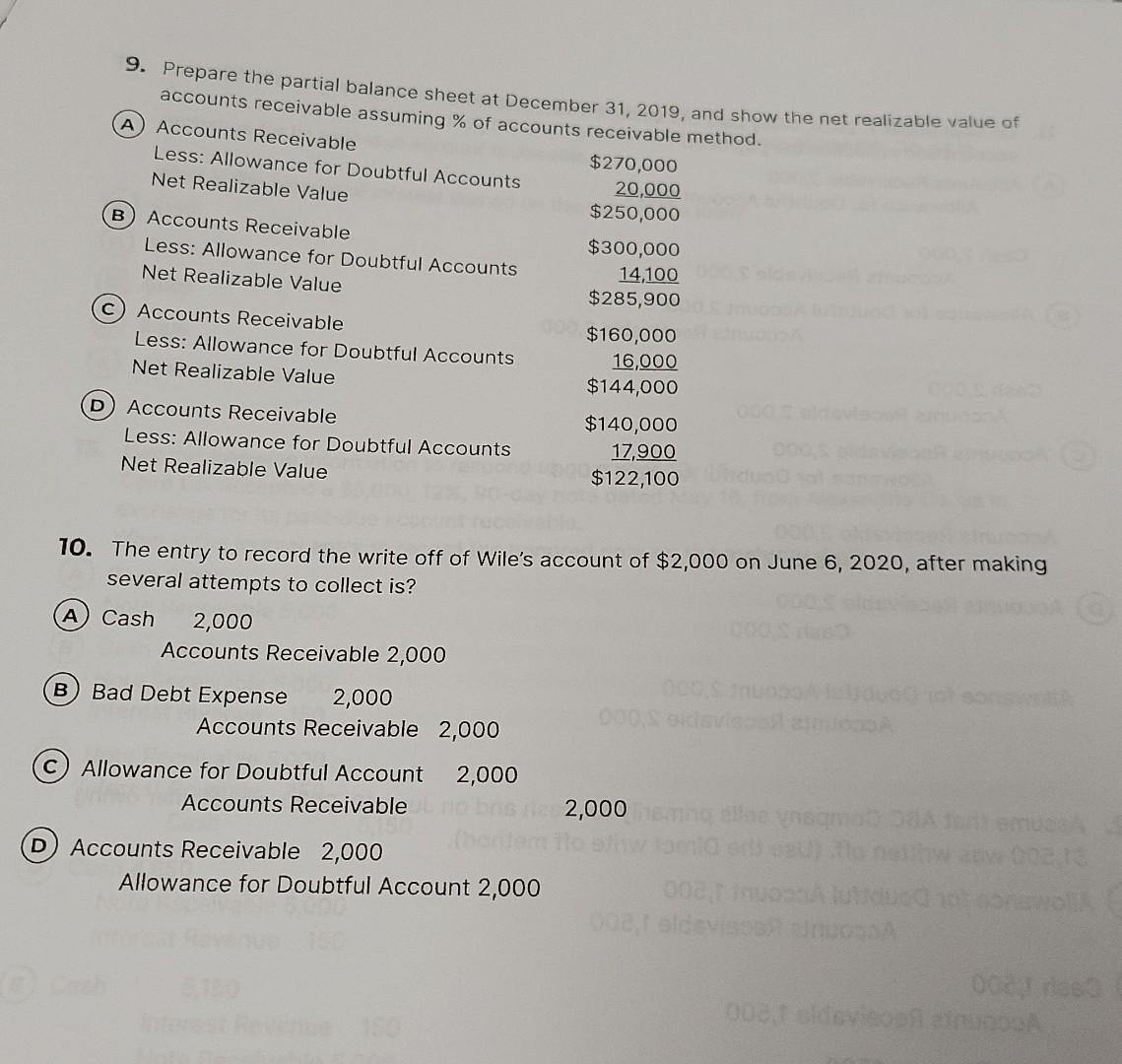

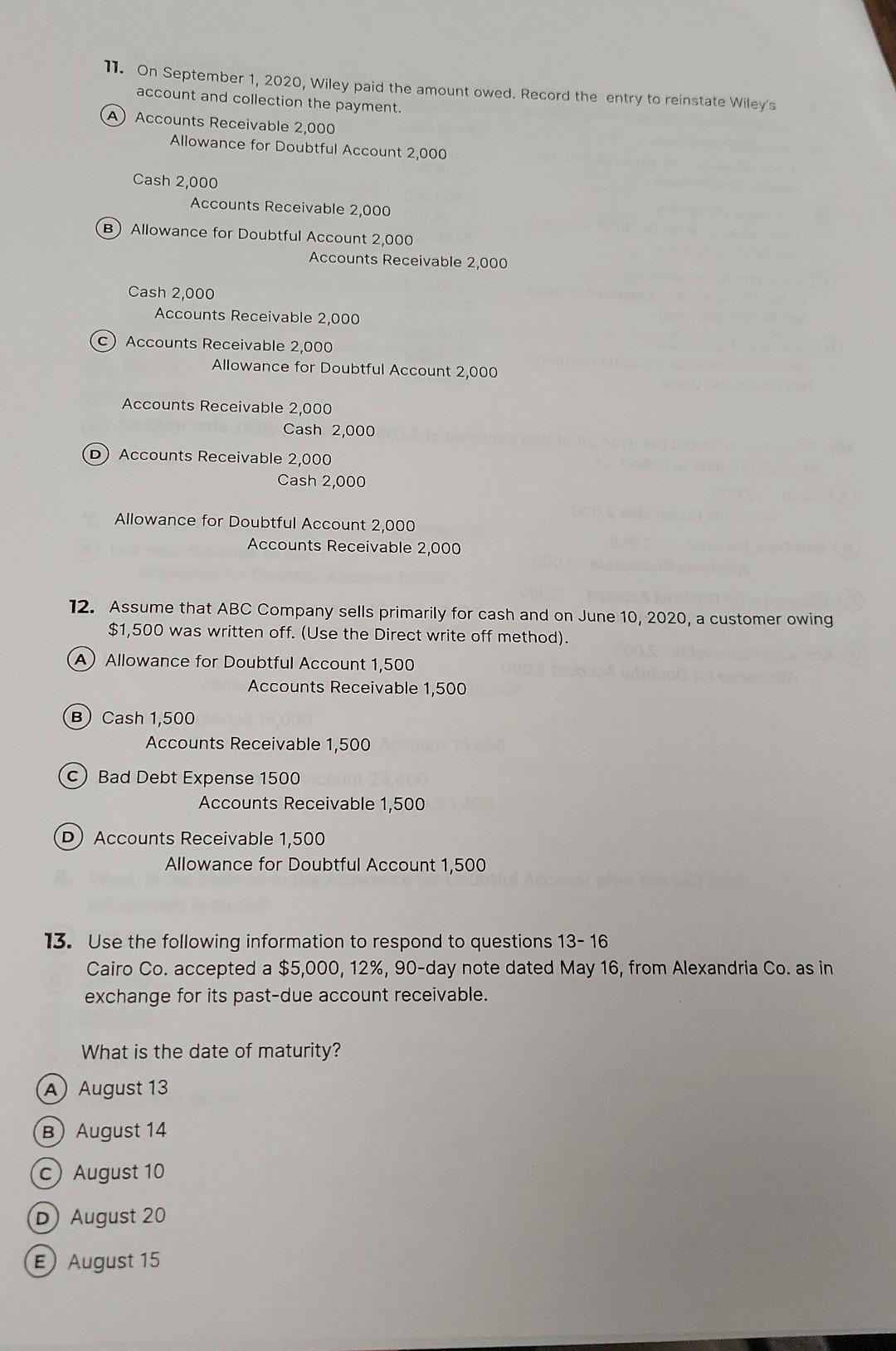

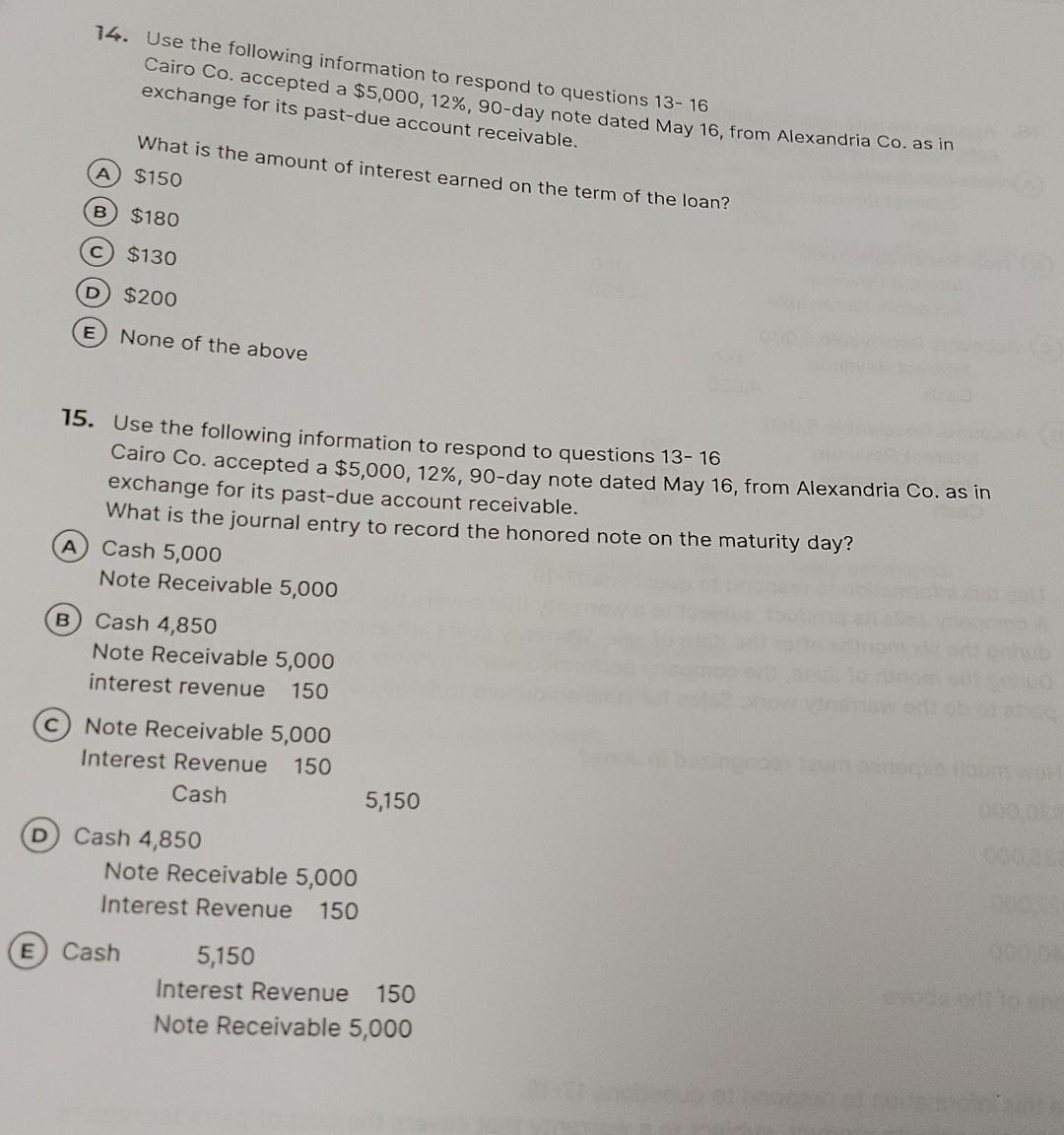

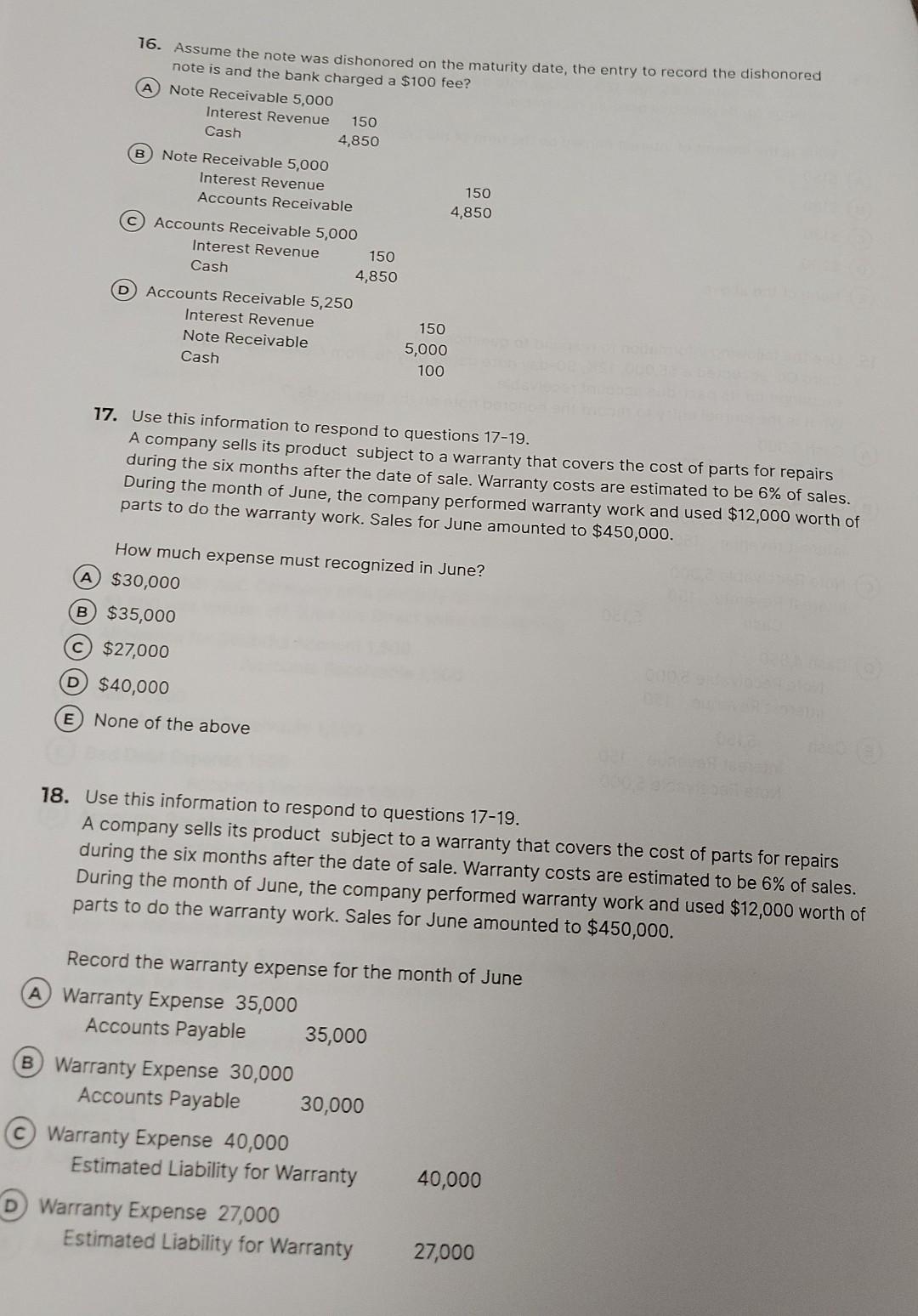

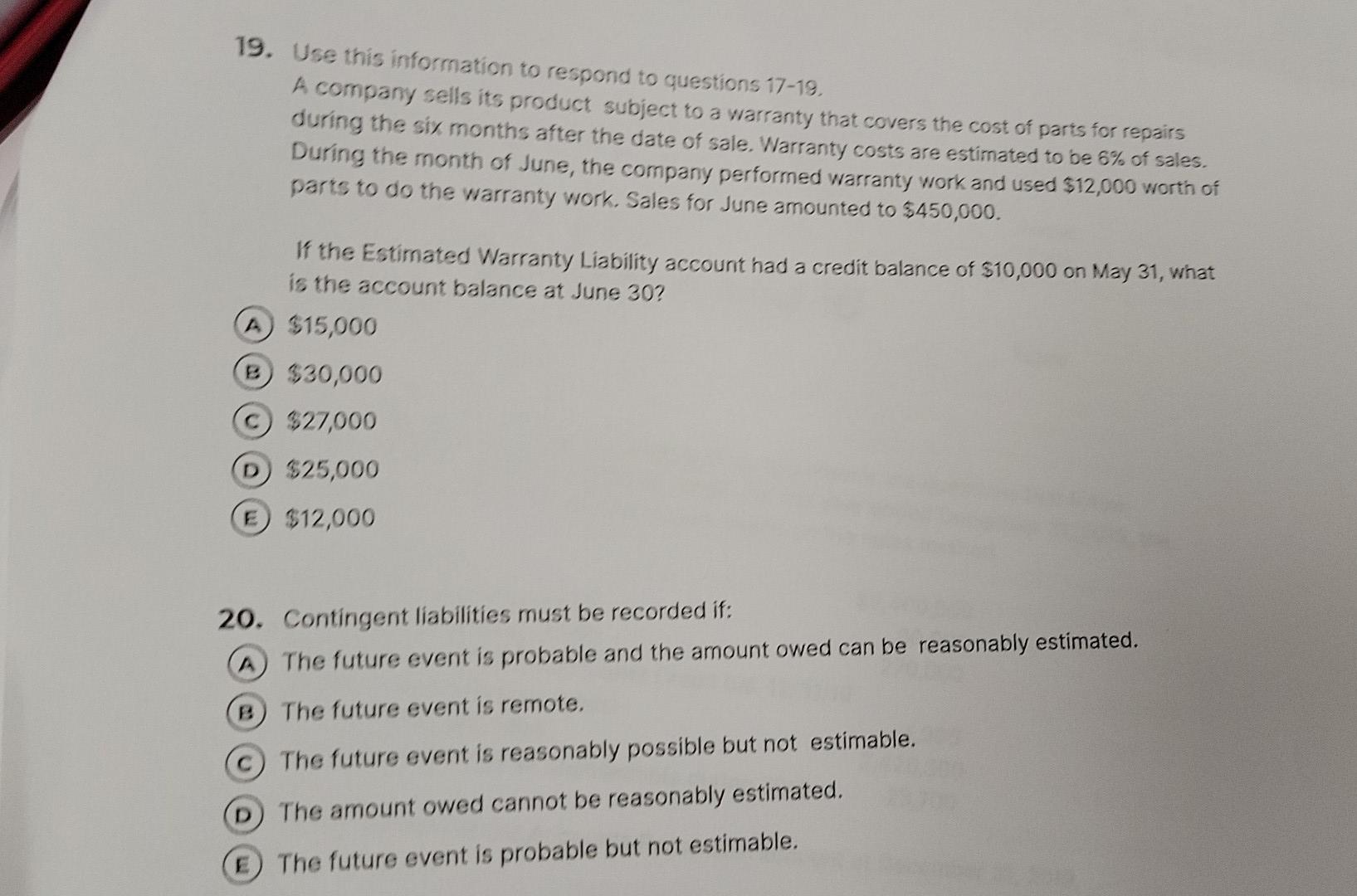

9. Prepare the partial balance sheet at December 31, 2019, and show the net realizable value of accounts receivable assuming % of accounts receivable method. (A Accounts Receivable $270,000 Less: Allowance for Doubtful Accounts 20.000 Net Realizable Value $250,000 B) Accounts Receivable $300,000 Less: Allowance for Doubtful Accounts Net Realizable Value $285,900 Accounts Receivable $160,000 Less: Allowance for Doubtful Accounts 16,000 Net Realizable Value $144,000 D) Accounts Receivable $140,000 Less: Allowance for Doubtful Accounts 17,900 Net Realizable Value $122,100 14,100 10. The entry to record the write off of Wile's account of $2,000 on June 6, 2020, after making several attempts to collect is? A Cash 2,000 Accounts Receivable 2,000 B Didove Bad Debt Expense 2,000 Accounts Receivable 2,000 Allowance for Doubtful Account 2,000 Accounts Receivable 2,000 D Accounts Receivable 2,000 Allowance for Doubtful Account 2,000 nammu 021 00C, olde oones 00din 11. On September 1, 2020, Wiley paid the amount owed. Record the entry to reinstate Wiley's account and collection the payment. A Accounts Receivable 2,000 Allowance for Doubtful Account 2,000 Cash 2,000 Accounts Receivable 2,000 B Allowance for Doubtful Account 2,000 Accounts Receivable 2,000 Cash 2,000 Accounts Receivable 2,000 C Accounts Receivable 2,000 Allowance for Doubtful Account 2,000 Accounts Receivable 2,000 Cash 2,000 Accounts Receivable 2,000 Cash 2,000 Allowance for Doubtful Account 2,000 Accounts Receivable 2,000 12. Assume that ABC Company sells primarily for cash and on June 10, 2020, a customer owing $1,500 was written off. (Use the Direct write off method). A Allowance for Doubtful Account 1,500 Accounts Receivable 1,500 B) Cash 1,500 Accounts Receivable 1,500 Bad Debt Expense 1500 Accounts Receivable 1,500 Accounts Receivable 1,500 Allowance for Doubtful Account 1,500 13. Use the following information to respond to questions 13-16 Cairo Co. accepted a $5,000, 12%, 90-day note dated May 16, from Alexandria Co. as in exchange for its past-due account receivable. What is the date of maturity? A August 13 B August 14 C August 10 D) August 20 E August 15 14. Use the following information to respond to questions 13-16 Cairo Co. accepted a $5,000, 12%, 90-day note dated May 16, from Alexandria Co. as in exchange for its past-due account receivable. What is the amount of interest earned on the term of the loan? $150 B $180 C) $130 D $200 E None of the above 15. Use the following information to respond to questions 13-16 Cairo Co. accepted a $5,000, 12%, 90-day note dated May 16, from Alexandria Co. as in exchange for its past-due account receivable. What is the journal entry to record the honored note on the maturity day? Cash 5,000 Note Receivable 5,000 B Cash 4,850 Note Receivable 5,000 interest revenue 150 Note Receivable 5,000 Interest Revenue 150 Cash 5,150 D) Cash 4,850 Note Receivable 5,000 Interest Revenue 150 E Cash 5,150 Interest Revenue 150 Note Receivable 5,000 16. Assume the note was dishonored on the maturity date, the entry to record the dishonored note is and the bank charged a $100 fee? A Note Receivable 5,000 Interest Revenue 150 Cash 4,850 B Note Receivable 5,000 Interest Revenue Accounts Receivable 150 4,850 C Accounts Receivable 5,000 Interest Revenue Cash 4,850 150 D Accounts Receivable 5,250 Interest Revenue Note Receivable Cash 150 5,000 100 17. Use this information to respond to questions 17-19. A company sells its product subject to a warranty that covers the cost of parts for repairs during the six months after the date of sale. Warranty costs are estimated to be 6% of sales. During the month of June, the company performed warranty work and used $12,000 worth of parts to do the warranty work. Sales for June amounted to $450,000. How much expense must recognized in June? $30,000 B $35,000 C $27,000 D) $40,000 E) None of the above 18. Use this information to respond to questions 17-19. A company sells its product subject to a warranty that covers the cost of parts for repairs during the six months after the date of sale. Warranty costs are estimated to be 6% of sales. During the month of June, the company performed warranty work and used $12,000 worth of parts to do the warranty work. Sales for June amounted to $450,000. Record the warranty expense for the month of June A Warranty Expense 35,000 Accounts Payable 35,000 B Warranty Expense 30,000 Accounts Payable 30,000 Warranty Expense 40,000 Estimated Liability for Warranty 40,000 D Warranty Expense 27,000 Estimated Liability for Warranty 27,000 19. Use this information to respond to questions 17-19, A company sells its product subject to a warranty that covers the cost of parts for repairs during the six months after the date of sale, Warranty costs are estimated to be 6% of sales. During the month of June, the company performed warranty work and used $12,000 worth of parts to do the warranty work. Sales for June amounted to $450,000. If the Estimated Warranty Liability account had a credit balance of $10,000 on May 31, what is the account balance at June 302 A $15,000 B $30,000 $27,000 D) $25,000 E) $12,000 20. Contingent liabilities must be recorded if: A The future event is probable and the amount owed can be reasonably estimated. B) The future event is remote. The future event is reasonably possible but not estimable. The amount owed cannot be reasonably estimated. E The future event is probable but not estimable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts