Question: (1-2) Old Economy Traders opened an account to short sell 1,000 shares at the price per share of $40 of Internet Dreams. The initial margin

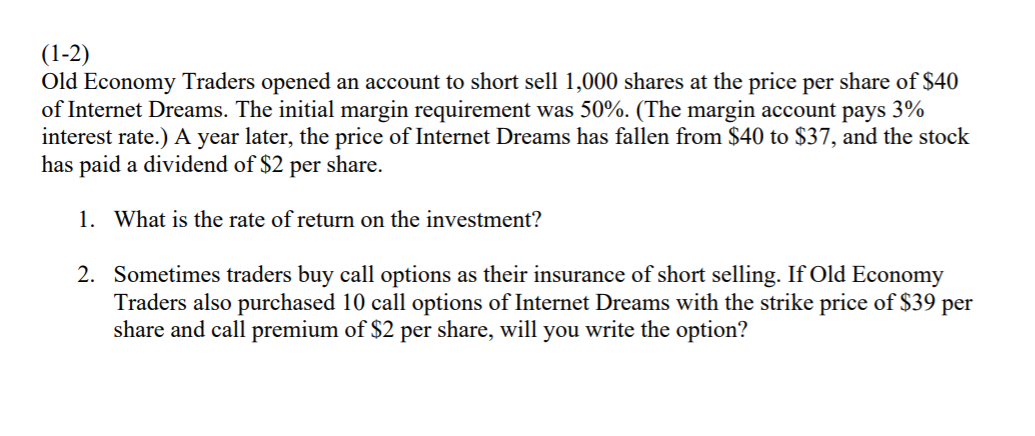

(1-2) Old Economy Traders opened an account to short sell 1,000 shares at the price per share of $40 of Internet Dreams. The initial margin requirement was 50%. (The margin account pays 3% interest rate.) A year later, the price of Internet Dreams has fallen from $40 to $37, and the stock has paid a dividend of $2 per share. 1. What is the rate of return on the investment? 2. Sometimes traders buy call options as their insurance of short selling. If Old Economy Traders also purchased 10 call options of Internet Dreams with the strike price of $39 per share and call premium of $2 per share, will you write the option? (1-2) Old Economy Traders opened an account to short sell 1,000 shares at the price per share of $40 of Internet Dreams. The initial margin requirement was 50%. (The margin account pays 3% interest rate.) A year later, the price of Internet Dreams has fallen from $40 to $37, and the stock has paid a dividend of $2 per share. 1. What is the rate of return on the investment? 2. Sometimes traders buy call options as their insurance of short selling. If Old Economy Traders also purchased 10 call options of Internet Dreams with the strike price of $39 per share and call premium of $2 per share, will you write the option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts