Question: 12. Please, explain if this is a finance or operating lease. Provide the calculations for each journal entry. Sage Hill Corporation recorded a right-of-use asset

12.

Please, explain if this is a finance or operating lease.

Provide the calculations for each journal entry.

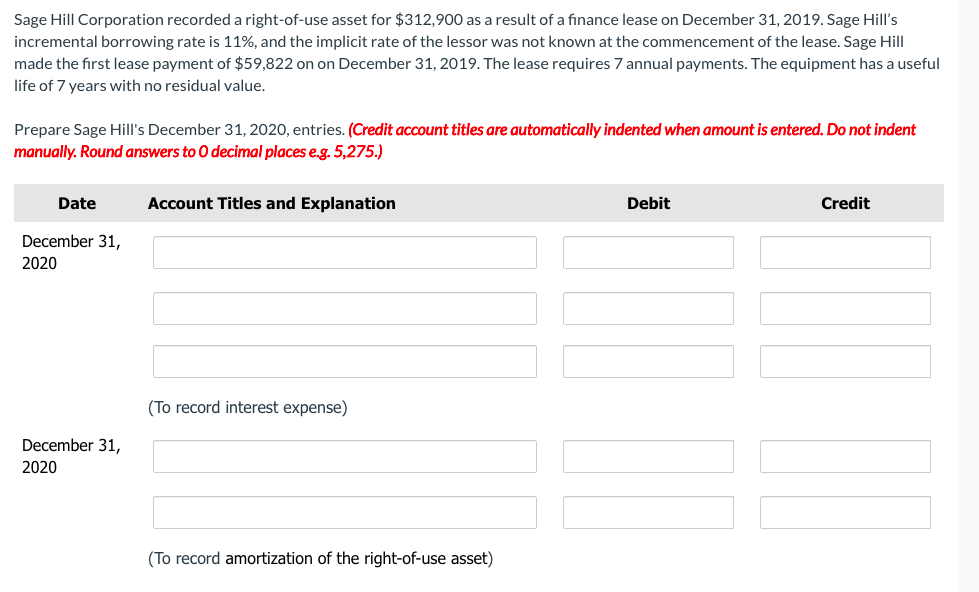

Sage Hill Corporation recorded a right-of-use asset for $312,900 as a result of a finance lease on December 31, 2019. Sage Hill's incremental borrowing rate is 11%, and the implicit rate of the lessor was not known at the commencement of the lease. Sage Hill made the first lease payment of $59,822 on on December 31, 2019. The lease requires 7 annual payments. The equipment has a useful life of 7 years with no residual value. Prepare Sage Hill's December 31, 2020, entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places e.g. 5,275.) Date Account Titles and Explanation Debit Credit December 31, 2020 (To record interest expense) December 31, 2020 (To record amortization of the right-of-use asset)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts