Question: 12. Present Value and Multiple Cash Flows Investment X offers to pay you $6,000 per year for nine years, whereas Investment Y offers to pay

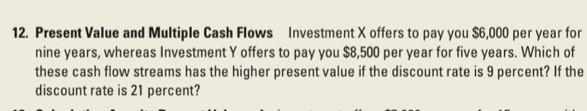

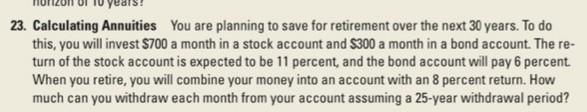

12. Present Value and Multiple Cash Flows Investment X offers to pay you $6,000 per year for nine years, whereas Investment Y offers to pay you $8,500 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 9 percent? If the discount rate is 21 percent? 23. Calculating Annuities You are planning to save for retirement over the next 30 years. To do this, you will invest $700 a month in a stock account and $300 a month in a bond account. The re- turn of the stock account is expected to be 11 percent, and the bond account will pay 6 percent When you retire, you will combine your money into an account with an 8 percent return. How much can you withdraw each month from your account assuming a 25-year withdrawal period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts