Question: 12. Present value with multiple cash flows Suppose we had an investment that was going to pay $100 at the end of every year for

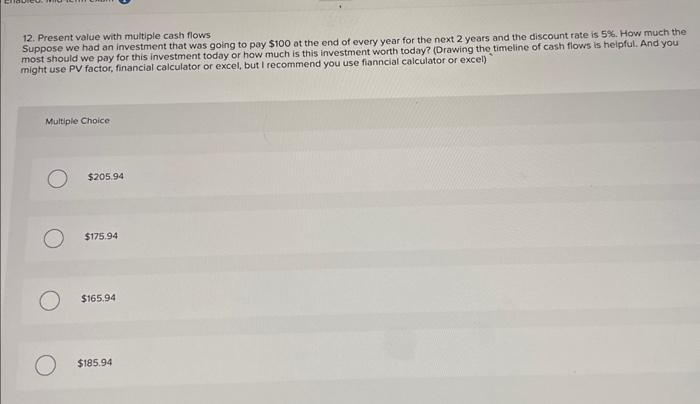

12. Present value with multiple cash flows Suppose we had an investment that was going to pay $100 at the end of every year for the next 2 years and the discount tate is 5%. How much the most should we pay for this investment today or how much is this investment worth today? (Drawing the timeline of cash fiows is helpful. And you might use PV factor, financial calculator or excel, but I recommend you use fianncial calculator or excel) Multiple Choice $205.94 $175.94 $165.94 $185,94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts