Question: 12. Problem 12-41 Carolyn owns a data processing company. She plans to buy an additional computer for $20,000, use it for three years, and sell

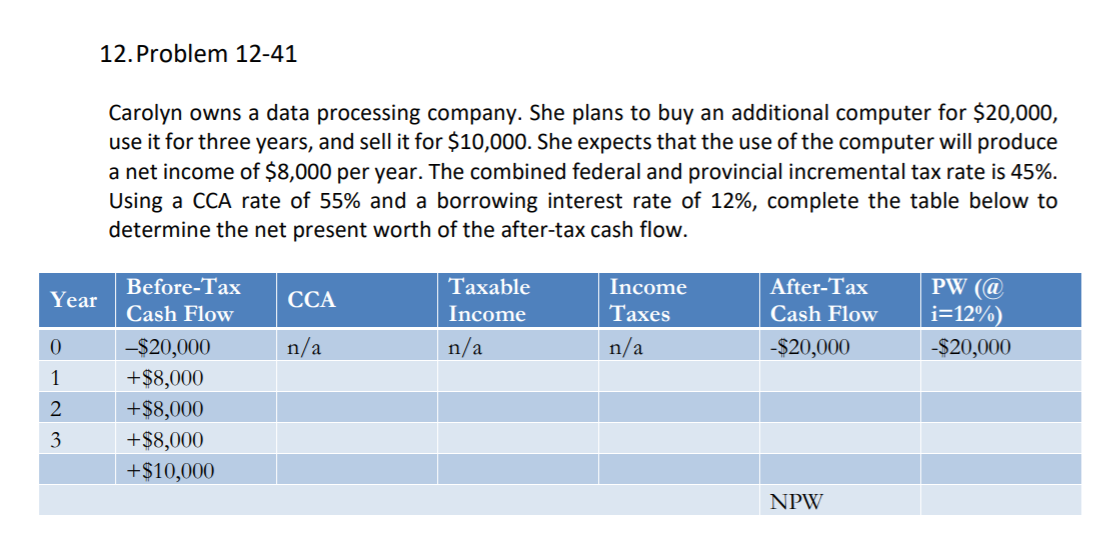

12. Problem 12-41 Carolyn owns a data processing company. She plans to buy an additional computer for $20,000, use it for three years, and sell it for $10,000. She expects that the use of the computer will produce a net income of $8,000 per year. The combined federal and provincial incremental tax rate is 45%. Using a CCA rate of 55% and a borrowing interest rate of 12%, complete the table below to determine the net present worth of the after-tax cash flow. Year Taxable Income n/a Income Taxes After-Tax Cash Flow -$20,000 PW (@ i=12%) -$20,000 n/a 0 1 2 3 Before-Tax Cash Flow -$20,000 +$8,000 +$8,000 +$8,000 +$10,000 NPW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts