Question: 12 Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

12

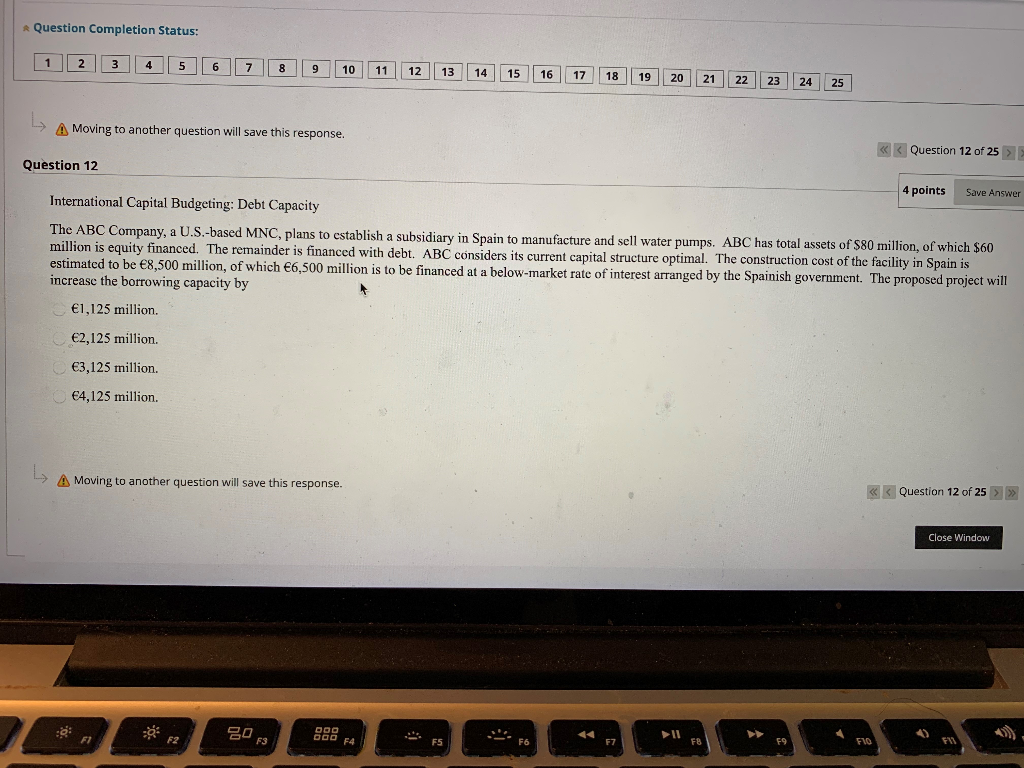

Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 A Moving to another question will save this response. > Question 12 4 points Save Answer International Capital Budgeting: Debt Capacity The ABC Company, a U.S.-based MNC, plans to establish a subsidiary in Spain to manufacture and sell water pumps. ABC has total assets of $80 million, of which $60 million is equity financed. The remainder is financed with debt. ABC considers its current capital structure optimal. The construction cost of the facility in Spain is estimated to be 8,500 million, of which 6,500 million is to be financed at a below-market rate of interest arranged by the Spanish government. The proposed project will increase the borrowing capacity by 1,125 million. 2,125 million. 3,125 million. 4,125 million La A Moving to another question will save this response. >> Close Window 000 F2 COD F4 FS F6 F7 FB FO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts