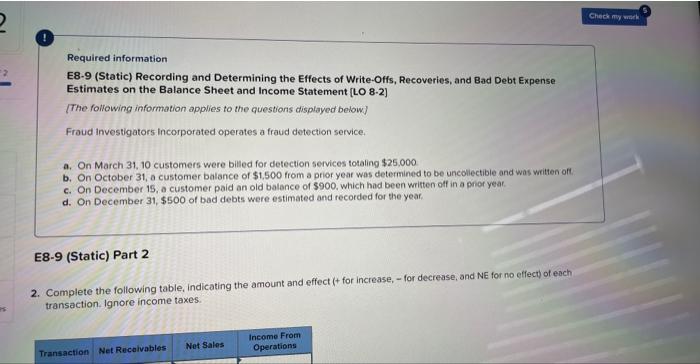

Question: 12 Required information E8-9 (Static) Recording and Determining the Effects of Write-Offs, Recoveries, and Bad Debt Expense Estimates on the Balance Sheet and Income Statement

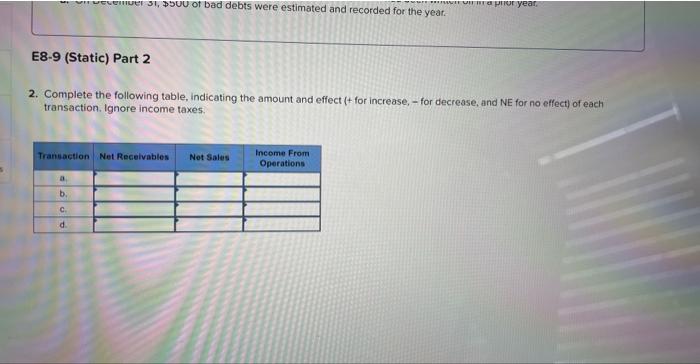

Required information E8-9 (Static) Recording and Determining the Effects of Write-Offs, Recoveries, and Bad Debt Expense Estimates on the Balance Sheet and Income Statement [LO 8-2] [The following information applies to the questions displayed below] Fraud investigators incorporated operates a fraud detection service. a. On March 31, 10 customers were billed for detection services totaling $25,000 b. On October 31, a customer balance of $1,500 from a prior yeat was determined to be uncoliectible and was written oft. c. On December 15, a customer paid an old balance of $900, which had been written off in a prior year. d. On December 31, $500 of bad debts were estimated and recorded for the year. E8-9 (Static) Part 2 2. Complete the following table, indicating the amount and effect (t for increase, - for decrease, and NE for no effect) of each transaction. Ignore income taxes. E8-9 (Static) Part 2 2. Complete the following table, indicating the amount and effect (+ for increase, - for decrease, and NE for no effect) of each transaction. Ignore income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts