Question: 1.2 REQUIRED Use the information given below to answer the following questions. 1.2.1 Calculate the labour cost to company in respect of K. Jasat for

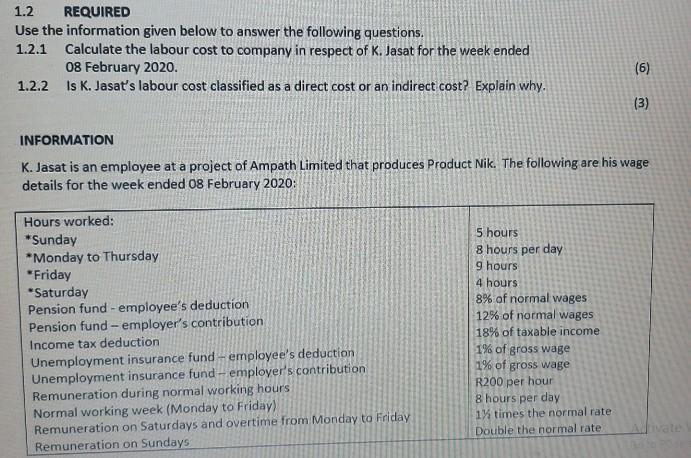

1.2 REQUIRED Use the information given below to answer the following questions. 1.2.1 Calculate the labour cost to company in respect of K. Jasat for the week ended 08 February 2020. 1.2.2 Is K. Jasat's labour cost classified as a direct cost or an indirect cost? Explain why. (6) (3) INFORMATION K. Jasat is an employee at a project of Ampath Limited that produces Product Nik. The following are his wage details for the week ended 08 February 2020: Hours worked: *Sunday *Monday to Thursday "Friday *Saturday Pension fund -employee's deduction Pension fund - employer's contribution Income tax deduction Unemployment insurance fund -employee's deduction Unemployment insurance fund - employer's contribution Remuneration during normal working hours Normal working week (Monday to Friday) Remuneration on Saturdays and overtime from Monday to Friday Remuneration on Sundays 5 hours 8 hours per day 9 hours 4 hours 8% of normal wages 12% of normal wages 18% of taxable income 1% of gross wage 1% of gross wage R200 per hour 8 hours per day 1% times the normal rate Double the normal rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts