Question: 12 The following data apply to Problems 17 and 18) Oklahoma Instruments (OI) is considering a project called F-200 that has an up-front cost of

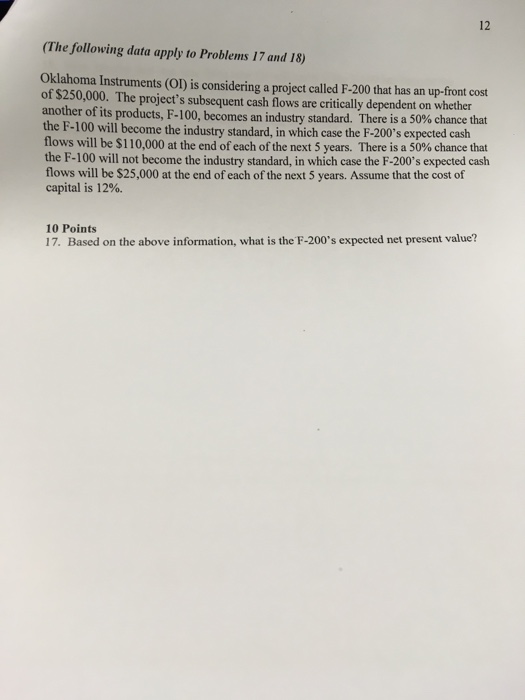

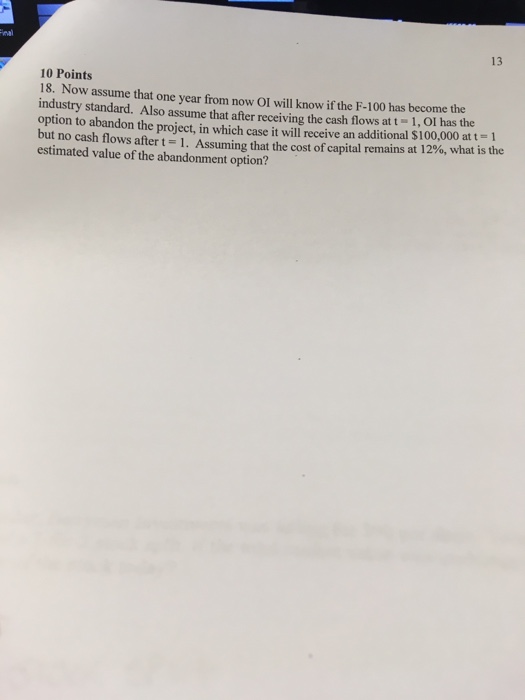

12 The following data apply to Problems 17 and 18) Oklahoma Instruments (OI) is considering a project called F-200 that has an up-front cost of $250,000. The project's subsequent cash flows are critically dependent on whether anoth er of its products, F-100, becomes an industry standard. There is a 50% chance that the F-100 will become the industry standard, in which case the F-200's expected cash flows will be $110,000 at the end of each ofthe next 5 years. There is a 50% chance that the F-100 will not become the industry standard, in which case the F-200's expected cash flows will be $25,000 at the end of each of the next 5 years. Assume that the cost of capital is 12%. 10 Points 17. Based on the above information, what is the F-200's expected net present value

Step by Step Solution

There are 3 Steps involved in it

Lets solve the problem stepbystep Given Data Initial Investment Cost 250000 outflow Two scenarios fo... View full answer

Get step-by-step solutions from verified subject matter experts