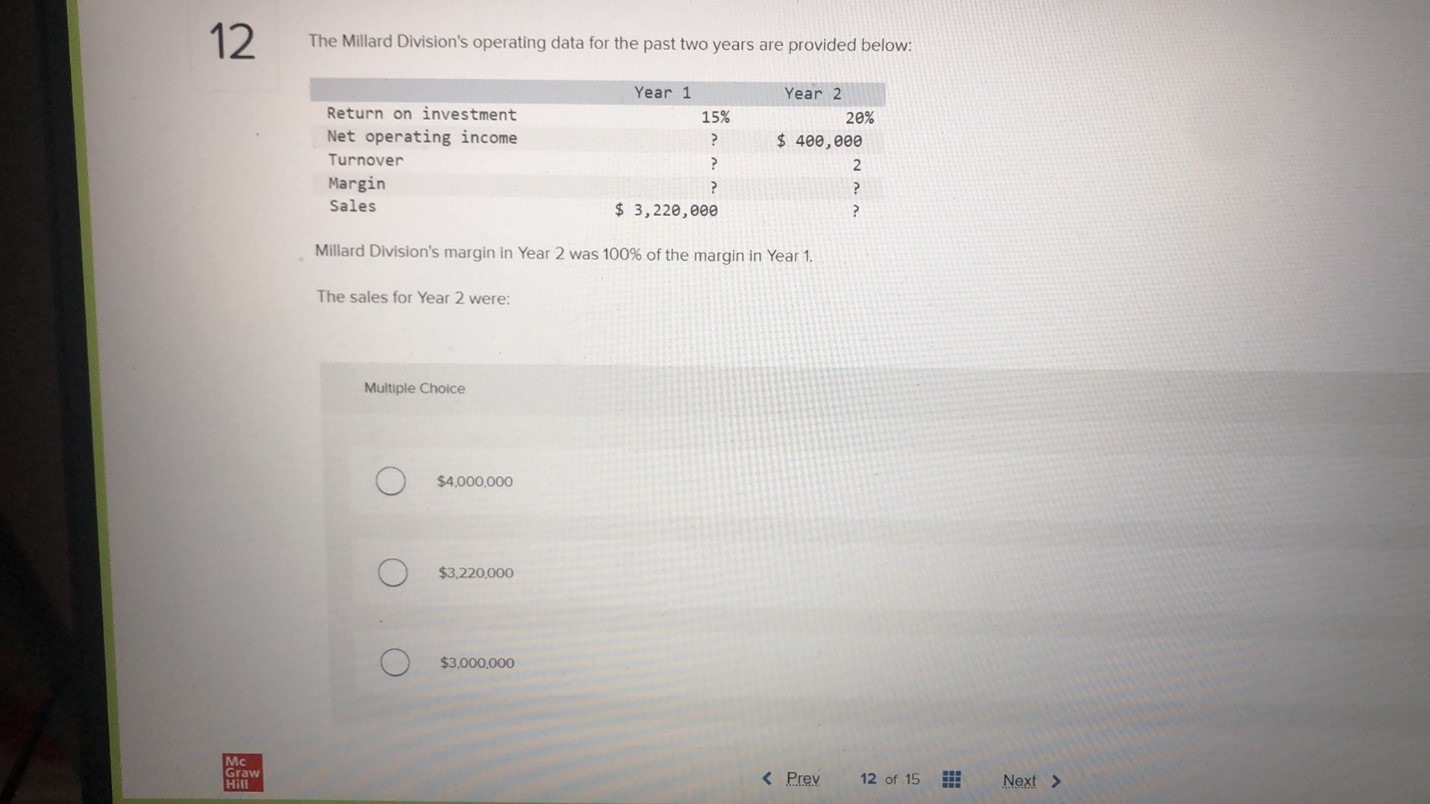

Question: 12 The Millard Division's operating data for the past two years are provided below: Year 1 Year 2 Return on investment 15% 20% Net operating

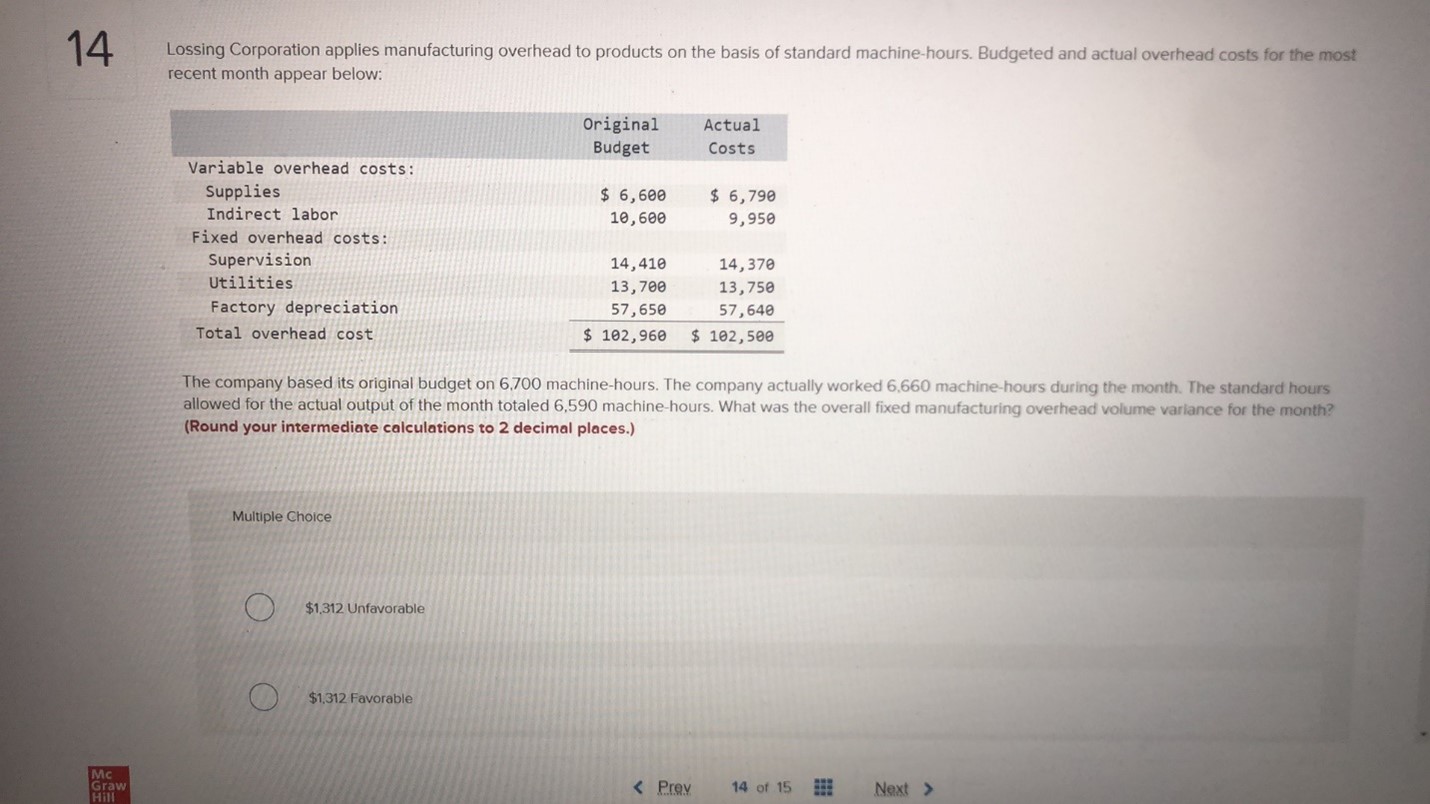

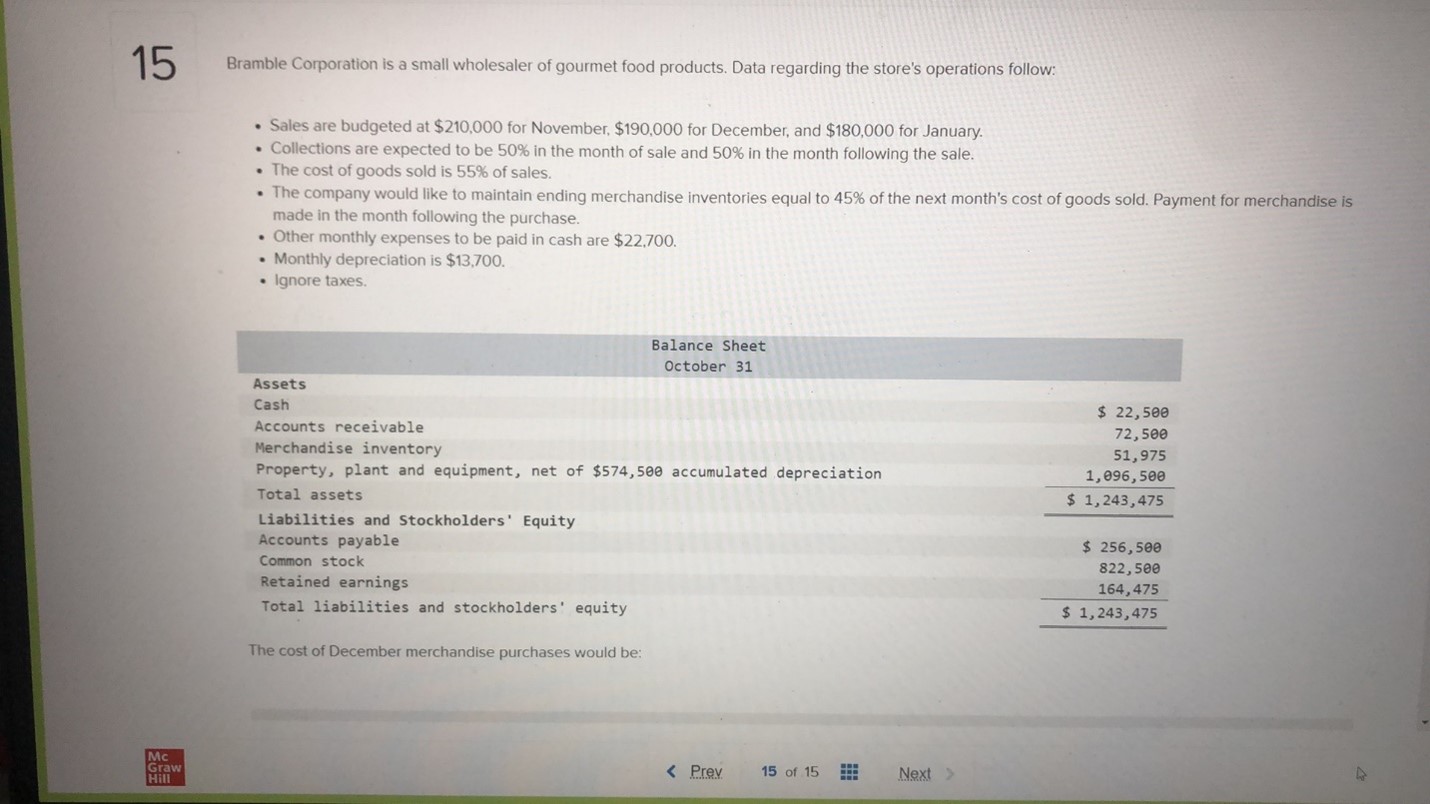

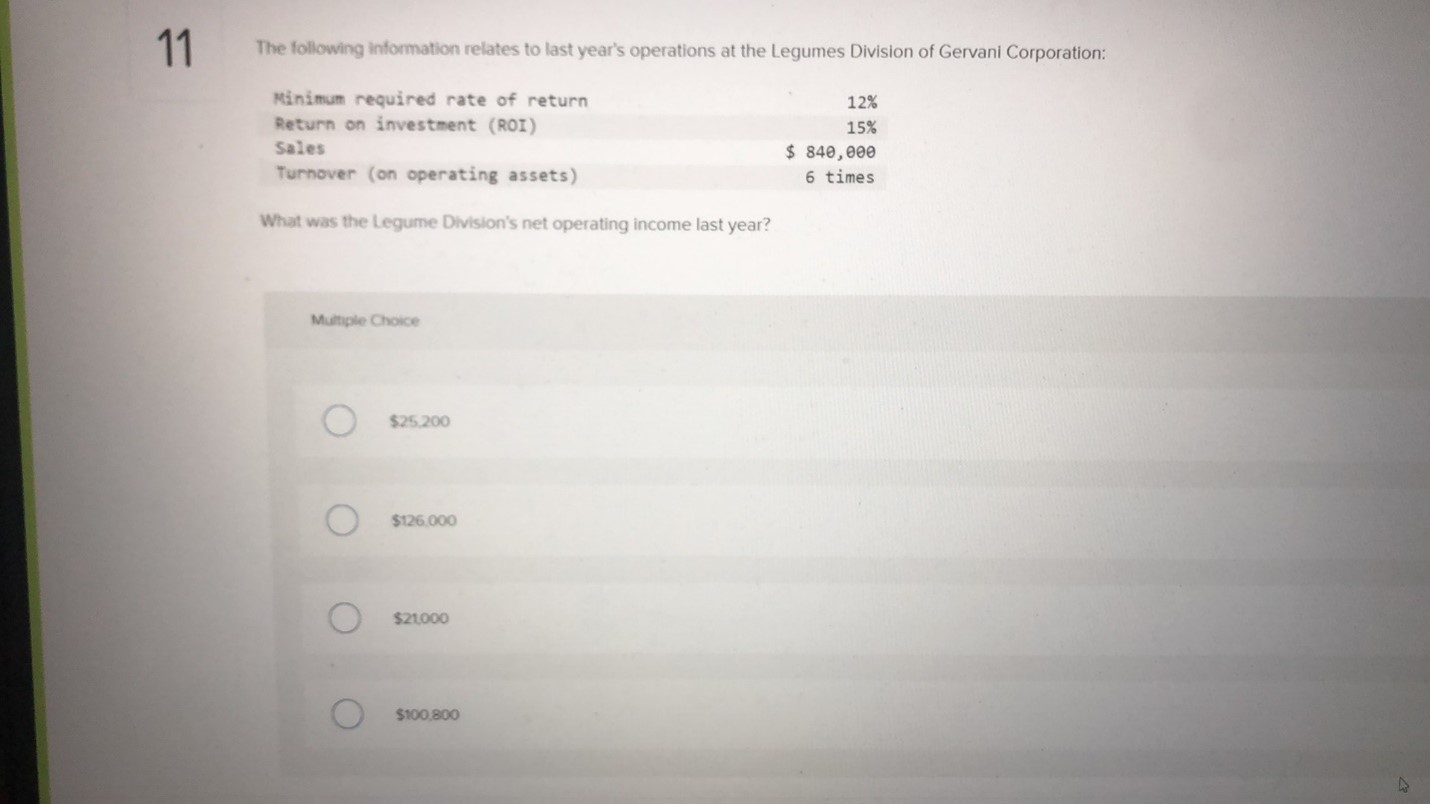

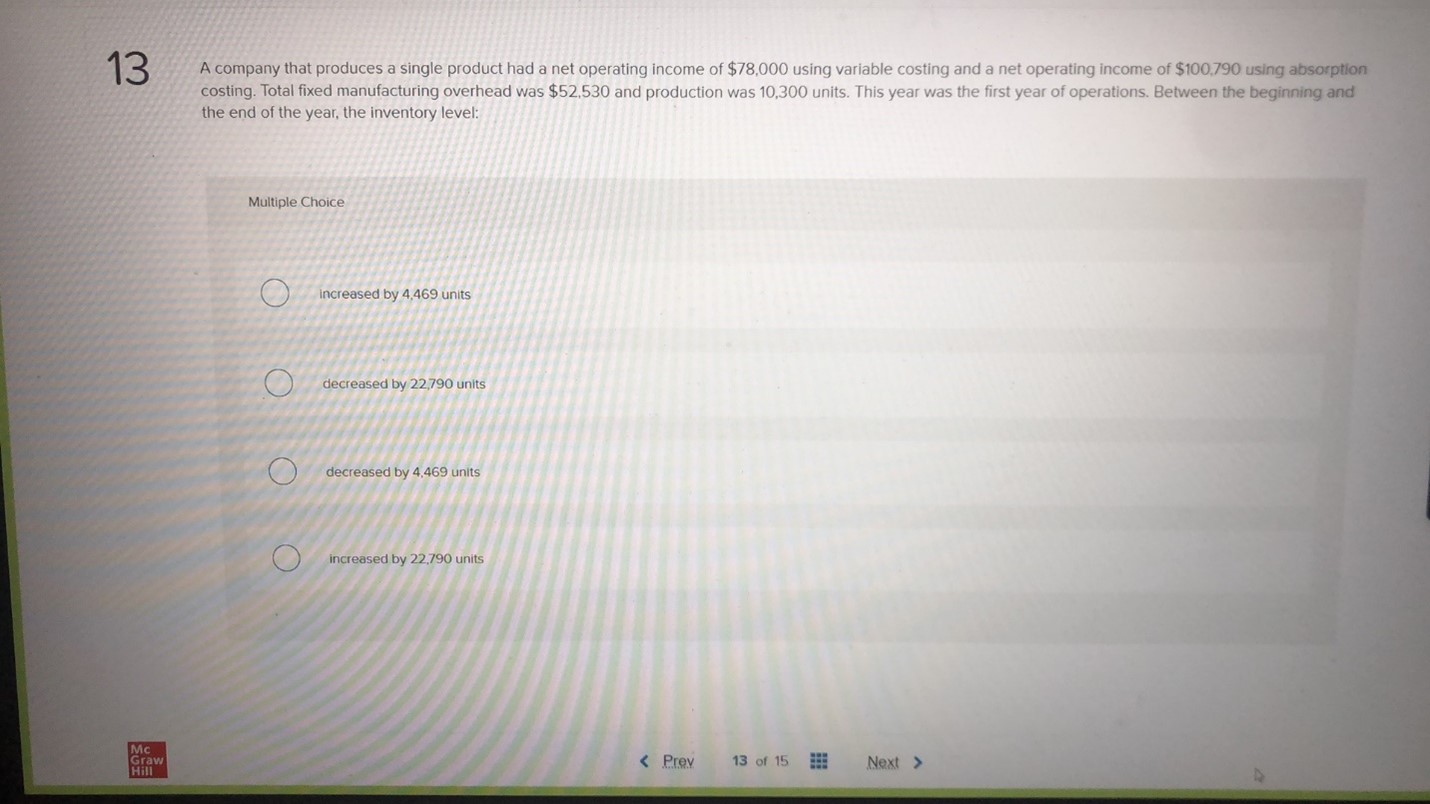

12 The Millard Division's operating data for the past two years are provided below: Year 1 Year 2 Return on investment 15% 20% Net operating income ? $ 400,000 Turnover Margin Sales $ 3,220,000 Millard Division's margin in Year 2 was 100% of the margin in Year 1. The sales for Year 2 were: Multiple Choice O $4,000,000 O $3,220,000 O $3,000.000 Mc Graw Hill 14 Lossing Corporation applies manufacturing overhead to products on the basis of standard machine-hours. Budgeted and actual overhead costs for the most recent month appear below: Original Actual Budget Costs Variable overhead costs: Supplies $ 6,600 $ 6,790 Indirect labor 10, 600 9,950 Fixed overhead costs : Supervision 14, 410 14, 370 Utilities 13, 700 13, 750 Factory depreciation 57, 650 57, 640 Total overhead cost $ 102,960 $ 102, 500 The company based its original budget on 6,700 machine-hours. The company actually worked 6.660 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 6,590 machine-hours. What was the overall fixed manufacturing overhead volume variance for the month? (Round your intermediate calculations to 2 decimal places.) Multiple Choice $1,312 Unfavorable O $1,312 Favorable Mc Graw 15 Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: . Sales are budgeted at $210,000 for November, $190,000 for December, and $180,000 for January. . Collections are expected to be 50% in the month of sale and 50% in the month following the sale. . The cost of goods sold is 55% of sales. . The company would like to maintain ending merchandise inventories equal to 45% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. . Other monthly expenses to be paid in cash are $22,700. . Monthly depreciation is $13,700. . Ignore taxes. Balance Sheet October 31 Assets Cash $ 22, 500 Accounts receivable 72, 500 Merchandise inventory 51, 975 Property, plant and equipment, net of $574, 500 accumulated depreciation 1, 096, 500 Total assets $ 1, 243, 475 Liabilities and Stockholders' Equity Accounts payable $ 256, 500 Common stock 822, 500 Retained earnings 164, 475 Total liabilities and stockholders' equity $ 1, 243, 475 The cost of December merchandise purchases would be: Mc Graw 11 The following information relates to last year's operations at the Legumes Division of Gervani Corporation: Minimum required rate of return 12% Return on investment (ROI) 15% Sales eee 'et8 $ Turnover (on operating assets) 6 times What was the Legume Division's net operating income last year? Multiple Choice O $25.200 O $126.000 O $21000 O $100.80013 A company that produces a single product had a net operating income of $78,000 using variable costing and a net operating income of $100,790 using absorption costing. Total fixed manufacturing overhead was $52,530 and production was 10,300 units. This year was the first year of operations. Between the beginning and the end of the year, the inventory level: Multiple Choice increased by 4,469 units O decreased by 22,790 units O decreased by 4,469 units O increased by 22,790 units Mc Prav

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts