Question: 12. TP (a real estate developer) has subdivided a large tract of land, installed water and sewer lines and the necessary roads. He has sold

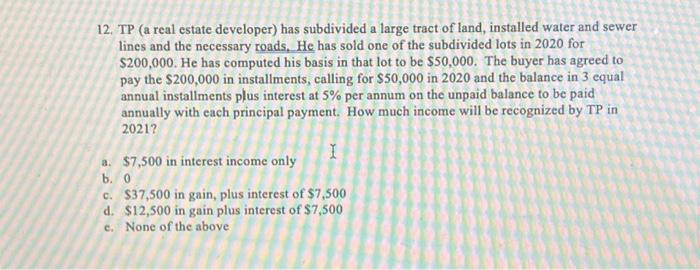

12. TP (a real estate developer) has subdivided a large tract of land, installed water and sewer lines and the necessary roads, He has sold one of the subdivided lots in 2020 for $200,000. He has computed his basis in that lot to be $50,000. The buyer has agreed to pay the $200,000 in installments, calling for $50,000 in 2020 and the balance in 3 equal annual installments plus interest at 5% per annum on the unpaid balance to be paid annually with each principal payment. How much income will be recognized by TP in 2021 ? a. $7,500 in interest income only b. 0 c. $37,500 in gain, plus interest of $7,500 d. $12,500 in gain plus interest of $7,500 c. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts