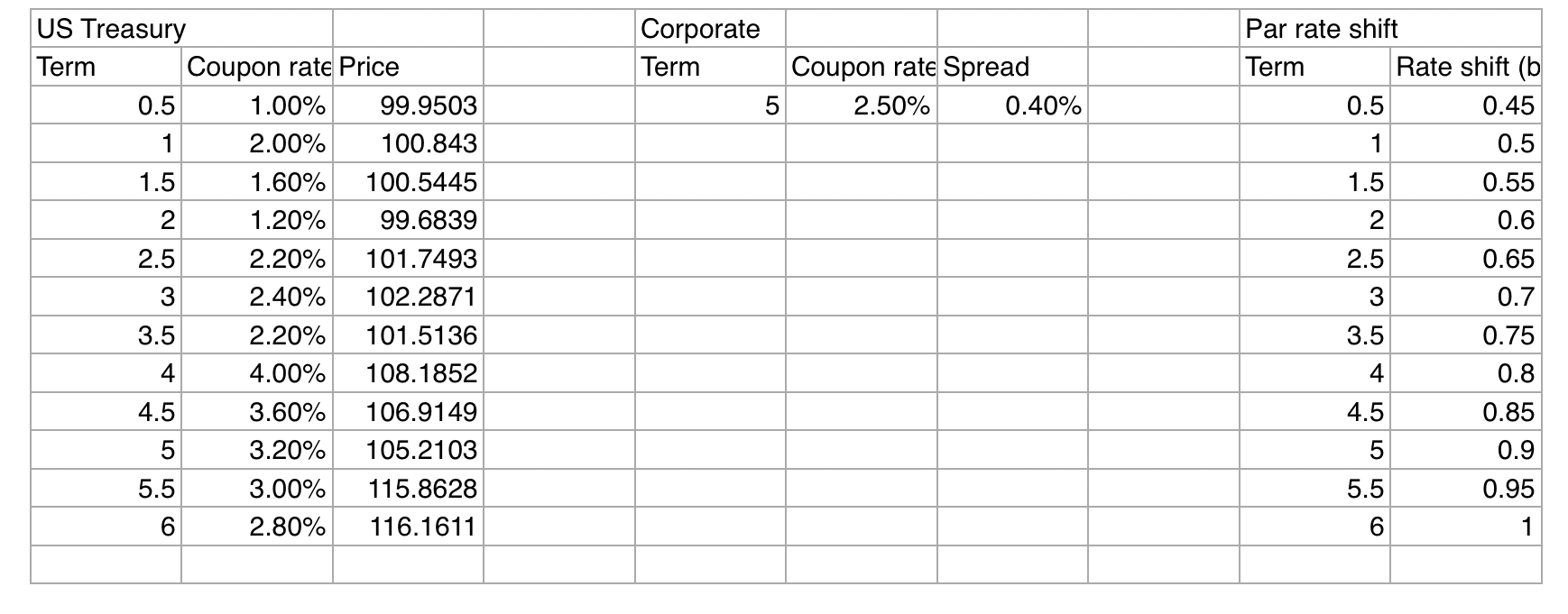

Question: 12 Treasury note prices with face amount $100 are given in the attached excel sheet. Coupon payments are all semiannual and no accrued interest. Suppose

12 Treasury note prices with face amount $100 are given in the attached excel sheet. Coupon payments are all semiannual and no accrued interest. Suppose that the benchmark spot rates are constructed with the Treasury bond prices. 1) Derive the par rates with the 12 Treasury notes. 2) Calculate the price of corporate bond, whose term is 5 -year, coupon rate 2.5%, and spread with respect to the forward rates 0.4%. 3) Calculate DV01, Duration and Convexity of the corporate bond with respect to the par rates. The par rate shifts are given in the excel sheet and the spread is assumed to remain unchanged. 4) Break the term structure of the forward rates into three segments, 0.5 - 2 year, 2.5 - 4 years and 4.5 - 6 years. Calculate the forward-bucket 01 's of the corporate bond for all segments (1bp shift of all forward rates only in the segement). 5) You are a market maker of bond trading and buys $10,000,000 face amount of the corporate bond from a client. You need to hedge the risk of the corporate bond but cannot sell it immediately. Discuss how to hedge the risk with the Treasury bonds. The report should be in pdf or word format. You can attach other files that describe how you calculate them. Remark) Count the number of days simply as 0.5 year =1/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts