Question: 12. Using Return Destitutions (LO4, CFA2) Based on the historical record, if you invest in the long-term U.S Treasury bonds, what is the approximate probability

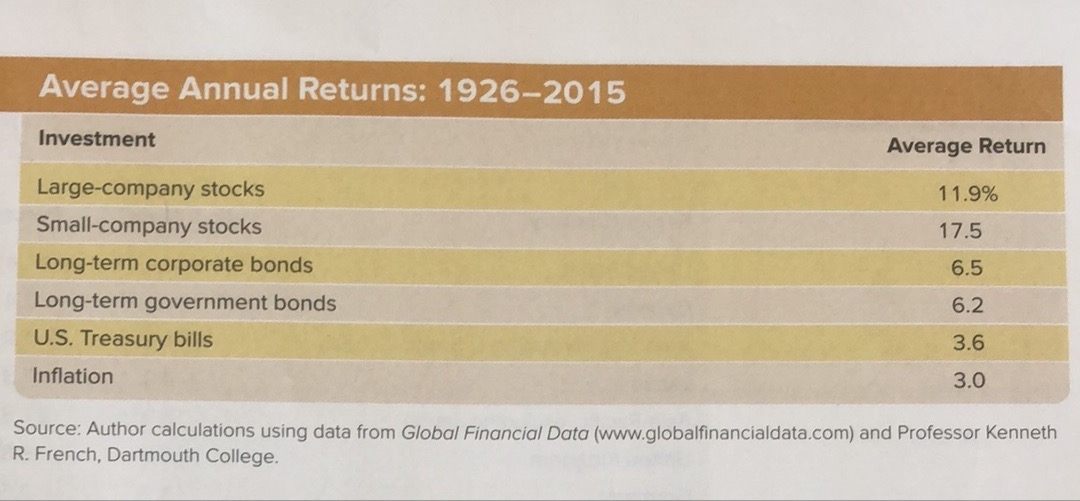

12. Using Return Destitutions (LO4, CFA2) Based on the historical record, if you invest in the long-term U.S Treasury bonds, what is the approximate probability that your return will be below -3.9 percent in a given year? What range of returns would you expect to see 95 percent of the time? 99 percent of the time?

Average Annual Returns: 1926-2015 Investment Average Return 11.9% 17.5 6.5 Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds U.S. Treasury bills Inflation 6.2 3.6 3.0 Source: Author calculations using data from Global Financial Data (www.globalfinancialdata.com) and Professor Kenneth R. French, Dartmouth College. Average Annual Returns: 1926-2015 Investment Average Return 11.9% 17.5 6.5 Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds U.S. Treasury bills Inflation 6.2 3.6 3.0 Source: Author calculations using data from Global Financial Data (www.globalfinancialdata.com) and Professor Kenneth R. French, Dartmouth College

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts