Question: 12. What is a difference between a forward contract and a future contract? ntract A. The price of a forward contract is fixed over the

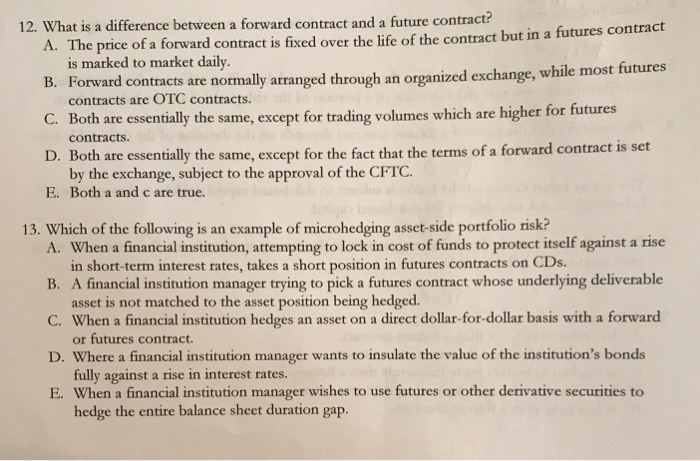

12. What is a difference between a forward contract and a future contract? ntract A. The price of a forward contract is fixed over the life of the contract but in a futures co is marked to market daily. B. Forward contracts are normally arranged through an organized exchange, while most futures contracts are OTC contracts. C. Both are essentially the same, except for trading volumes which are higher for f utures contracts. D. Both are essentially the same, except for the fact that the terms of a forward contract is set by the exchange, subject to the approval of the CFTC E. Both a and c are true. 13. Which of the following is an example of microhedging asset-side portfolio risk? A. When a financial institution, attempting to lock in cost of funds to protect itself against a rise B. A financial institution manager trying to pick a futures contract whose underlying deliverable C. When a financial institution hedges an asset on a direct dollar-for-dollar basis with a forward D. Where a financial institution manager wants to insulate the value of the institution's bonds E. When a financial institution manager wishes to use futures or other derivative securities to in short-term interest rates, takes a short position in futures contracts on CDs asset is not matched to the asset position being hedged. or futures contract. fully against a rise in interest rates. hedge the entire balance sheet duration gap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts