Question: 12. When callable bonds are redeemed below their carrying value a. Gain on Redemption of Bonds is credited b. Loss on Redemption of Bonds is

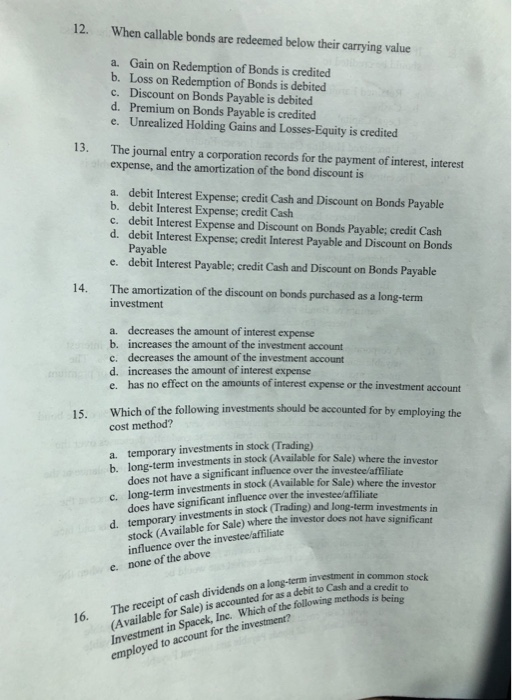

12. When callable bonds are redeemed below their carrying value a. Gain on Redemption of Bonds is credited b. Loss on Redemption of Bonds is debited c. Discount on Bonds Payable is debited d. Premium on Bonds Payable is credited e. Unrealized Holding Gains and Losses-Equity is credited 13. The journal entry a corporation records for the payment of interest, interest expense, and the amortization of the bond discount is a. debit Interest Expense; credit Cash and Discount on Bonds Payable b. debit Interest Expense; credit Cash c. debit Interest Expense and Discount on Bonds Payable; credit Cash d. debit Interest Expense; credit Interest Payable and Discount on Bonds Payable debit Interest Payable; credit Cash and Discount on Bonds Payable e. 14. The amortization of the discount on bonds purchased as a long-term investment a. decreases the amount of interest expense b. increases the amount of the investment account c. decreases the amount of the investment account d. increases the amount of interest expense e. has no effect on the amounts of interest expense or the investment account Which of the following investments should be accounted for by employing the cost method? 15. temporary investments in stock (Trading) long-term investments in stock (Available for Sale) where the in does not have a signiticant intluence over the investee/affiliate a. b. c. long-term in d. temporary investments in stock (Trading) and lonstea vestments in stock (A vailable for Sale) where the investor investee/affiliate does have significant influence over the stock (Available for Sale) where the investor does not hayestments in influence over the investee/affiliate none of the above e. (Available for Sale) is accounted for as a debit to Cashommon in Spacek, Inc. Which of the folowing methods istedit to The receipt of cash dividends on a long-term Investment in Spacek, Inc. Which of the following employed to Cash and a to methods is being 16. to account for the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts