Question: 12. When using the Bardahl formula, an increase in accounts payable (while holding purch holding purchases and operating expenses constant) has which of the following

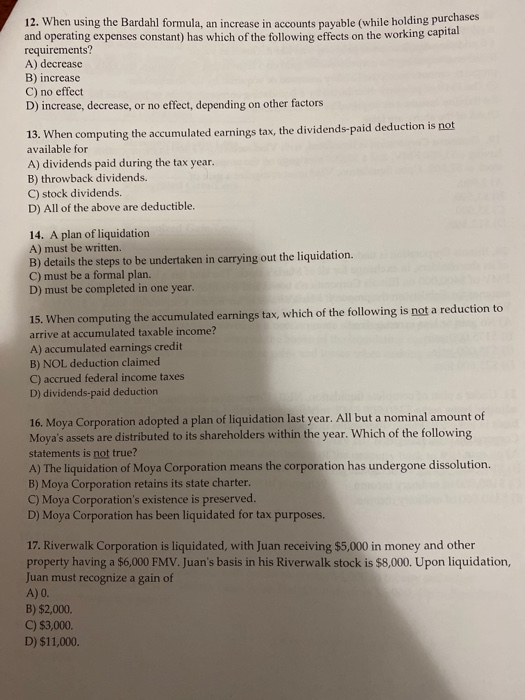

12. When using the Bardahl formula, an increase in accounts payable (while holding purch holding purchases and operating expenses constant) has which of the following effects on the working capital requirements? A) decrease B) increase C) no effect D) increase, decrease, or no effect, depending on other factors 13. When computing the accumulated earnings tax, the dividends-paid deduction is not available for A) dividends paid during the tax year. B) throwback dividends. C) stock dividends. D) All of the above are deductible. 14. A plan of liquidation A) must be written. B) details the steps to be undertaken in carrying out the liquidation. C) must be a formal plan. D) must be completed in one year. 15. When computing the accumulated earnings tax, which of the following is not a reduction to arrive at accumulated taxable income? A) accumulated earnings credit B) NOL deduction claimed C) accrued federal income taxes D) dividends-paid deduction 16. Moya Corporation adopted a plan of liquidation last year. All but a nominal amount of Moya's assets are distributed to its shareholders within the year. Which of the following statements is not true? A) The liquidation of Moya Corporation means the corporation has undergone dissolution. B) Moya Corporation retains its state charter. C) Moya Corporation's existence is preserved. D) Moya Corporation has been liquidated for tax purposes. 17. Riverwalk Corporation is liquidated, with Juan receiving $5,000 in money and other property having a $6,000 FMV. Juan's basis in his Riverwalk stock is $8,000. Upon liquidation, Juan must recognize a gain of A) O. B) $2,000. C) $3,000. D) $11,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts