Question: 12. You are also considering another project which has a physical life of 3 years; that is, the machinery will be totally worn out after

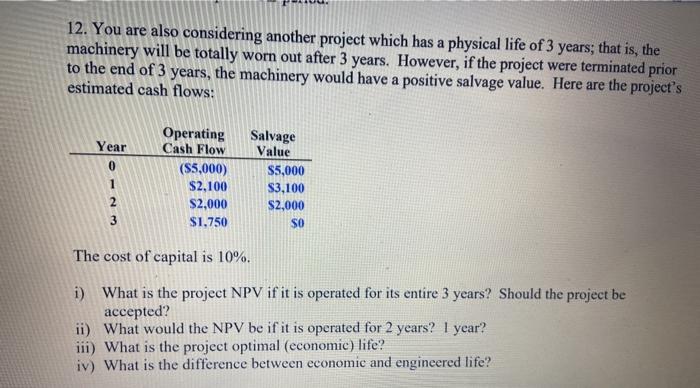

12. You are also considering another project which has a physical life of 3 years; that is, the machinery will be totally worn out after 3 years. However, if the project were terminated prior to the end of 3 years, the machinery would have a positive salvage value. Here are the project's estimated cash flows: Year Operating Cash Flow ($5,000) $2,100 $2,000 $1,750 Salvage Value $5,000 S3,100 $2,000 SO 1 2 3 The cost of capital is 10%. i) What is the project NPV if it is operated for its entire 3 years? Should the project be accepted? ii) What would the NPV be if it is operated for 2 years? 1 year? iii) What is the project optimal (economic) life? iv) What is the difference between economic and engineered life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts