Question: 12. You are considering buying the bonds of ABC Corp. They have a $1000 Par Value an 89 Coupon and have 3 years remaining until

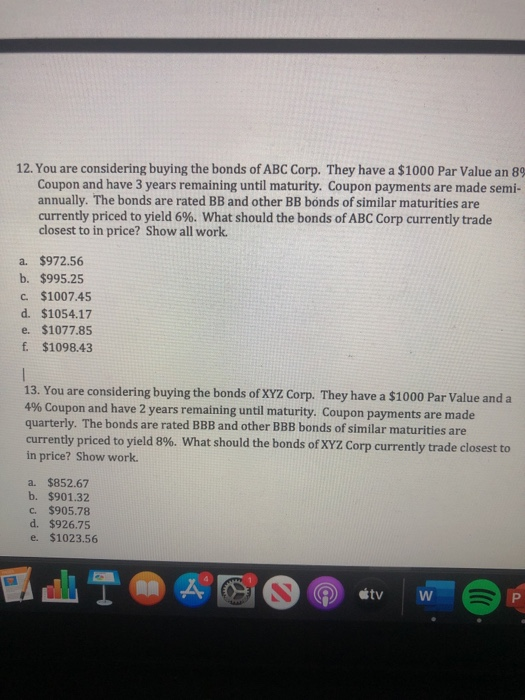

12. You are considering buying the bonds of ABC Corp. They have a $1000 Par Value an 89 Coupon and have 3 years remaining until maturity. Coupon payments are made semi- annually. The bonds are rated BB and other BB bnds of similar maturities are currently priced to yield 6%. What should the bonds of ABC Corp currently trade closest to in price? Show all work. a. $972.56 b. $995.25 c. $1007.45 d. $1054.17 e. $1077.85 f. $1098.43 13. You are considering buying the bonds of XYZ Corp. They have a $1000 Par Value and a 4% Coupon and have 2 years remaining until maturity. Coupon payments are made quarterly. The bonds are rated BBB and other BBB bonds of similar maturities are currently priced to yield 8%. What should the bonds of XYZ Corp currently trade closest to in price? Show work. a $852.67 b. $901.32 C. $905.78 d. $926.75 e. $1023.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts