Question: 1,2,3 are sub parts for the same question need around 250-300 words for each theory questions i will upvote thanks Building a net zero future

1,2,3 are sub parts for the same question need around 250-300 words for each theory questions i will upvote thanks

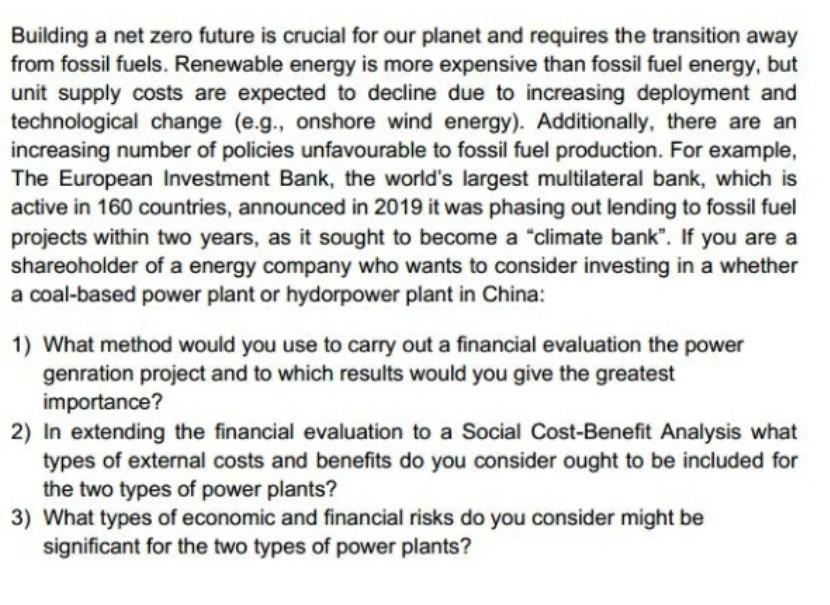

Building a net zero future is crucial for our planet and requires the transition away from fossil fuels. Renewable energy is more expensive than fossil fuel energy, but unit supply costs are expected to decline due to increasing deployment and technological change (e.g., onshore wind energy). Additionally, there are an increasing number of policies unfavourable to fossil fuel production. For example, The European Investment Bank, the world's largest multilateral bank, which is active in 160 countries, announced in 2019 it was phasing out lending to fossil fuel projects within two years, as it sought to become a "climate bank. If you are a shareoholder of a energy company who wants to consider investing in a whether a coal-based power plant or hydorpower plant in China: 1) What method would you use to carry out a financial evaluation the power genration project and to which results would you give the greatest importance? 2) In extending the financial evaluation to a Social Cost-Benefit Analysis what types of external costs and benefits do you consider ought to be included for the two types of power plants? 3) What types of economic and financial risks do you consider might be significant for the two types of power plants? Building a net zero future is crucial for our planet and requires the transition away from fossil fuels. Renewable energy is more expensive than fossil fuel energy, but unit supply costs are expected to decline due to increasing deployment and technological change (e.g., onshore wind energy). Additionally, there are an increasing number of policies unfavourable to fossil fuel production. For example, The European Investment Bank, the world's largest multilateral bank, which is active in 160 countries, announced in 2019 it was phasing out lending to fossil fuel projects within two years, as it sought to become a "climate bank. If you are a shareoholder of a energy company who wants to consider investing in a whether a coal-based power plant or hydorpower plant in China: 1) What method would you use to carry out a financial evaluation the power genration project and to which results would you give the greatest importance? 2) In extending the financial evaluation to a Social Cost-Benefit Analysis what types of external costs and benefits do you consider ought to be included for the two types of power plants? 3) What types of economic and financial risks do you consider might be significant for the two types of power plants

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts