Question: 1,2,3 please help me out i will thumb up QUESTION 2 When an investment appreciates in value during the investment holding period, the appreciation is

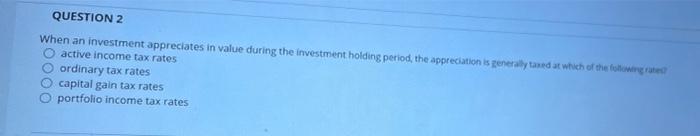

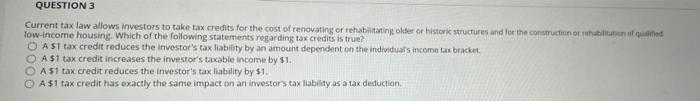

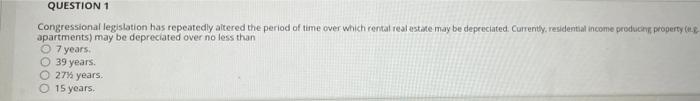

QUESTION 2 When an investment appreciates in value during the investment holding period, the appreciation is generally taned at which of the following red active income tax rates ordinary tax rates capital gain tax rates O portfolio income tax rates QUESTION 3 Current tax law allows investors to take tax credits for the cost of renovating or rehabilitating older or histork structures and for the construction or habiliten alquiled low-income housing. Which of the following statements regarding tax credits is true? O AST tax credit reduces the investor's tax liability by an amount dependent on the individual's income tax bracket O A $1 tax credit increases the investor's taxable income by $1. O A 51 tax credit reduces the investor's tax liability by $1. O A $1 tax credit has exactly the same impact on an investor's tax liability as a tax deduction QUESTION 1 Congressional legislation has repeatedly altered the period of time over which rental real estate may be depreciated. Currently, residential income producing property apartments) may be depreciated over no less than 7 years O 39 years. O 27% years. 15 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts