Question: 1:24 7 X MTH 237 A2 DOCX - 14 KB MTH 237: Class Exercise 2 Probability Distribution Two portfolios, A & B, are currently being

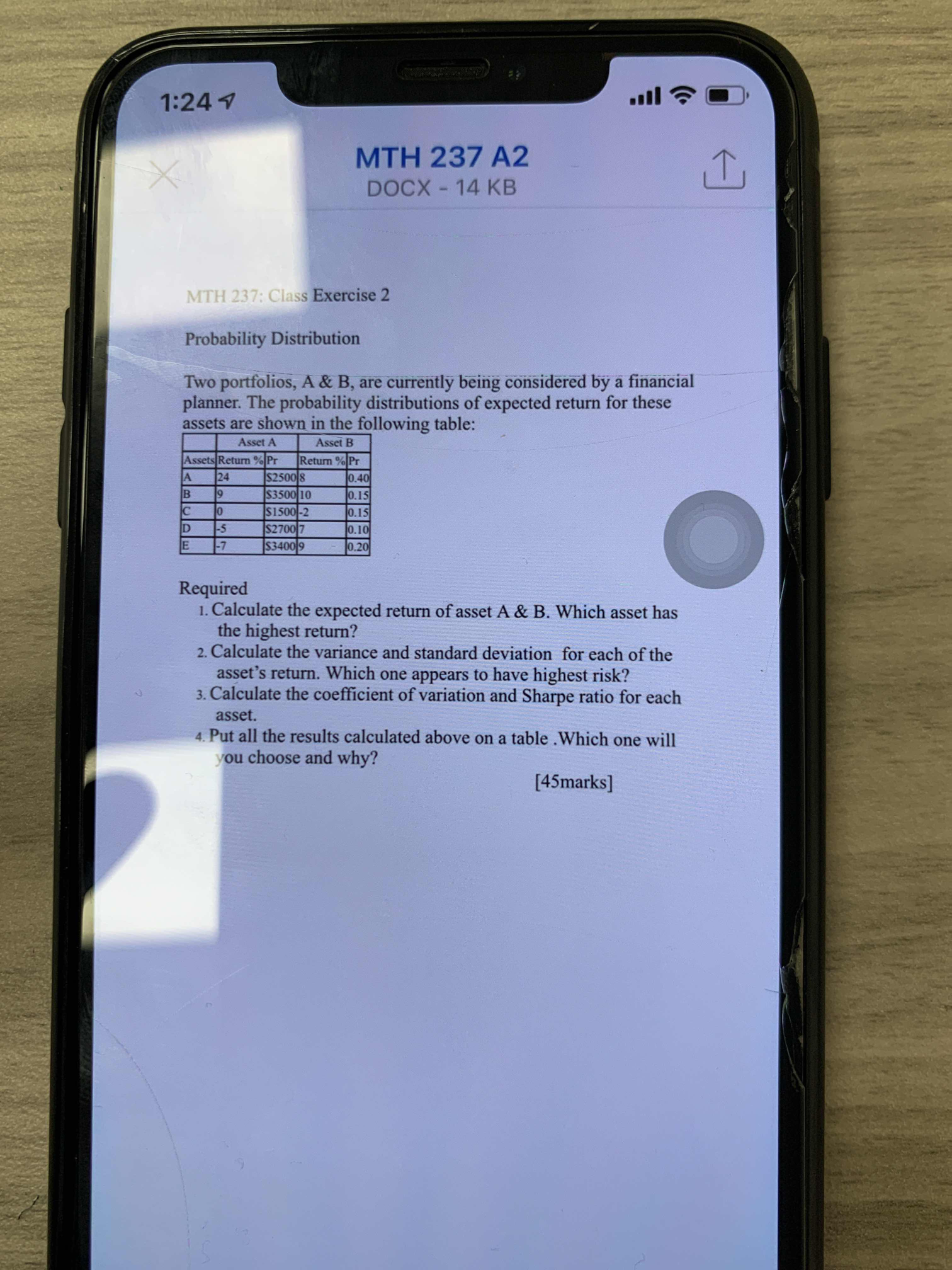

1:24 7 X MTH 237 A2 DOCX - 14 KB MTH 237: Class Exercise 2 Probability Distribution Two portfolios, A & B, are currently being considered by a financial planner. The probability distributions of expected return for these assets are shown in the following table: Asset A Asset B Assets Return % Pr Return % Pr 24 $2500 8 10.40 $3500 10 0.15 $1500 -2 0.15 $2700 $34009 0.20 Required 1. Calculate the expected return of asset A & B. Which asset has the highest return? 2. Calculate the variance and standard deviation for each of the asset's return. Which one appears to have highest risk? 3. Calculate the coefficient of variation and Sharpe ratio for each asset. 4. Put all the results calculated above on a table . Which one will you choose and why? [45marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts