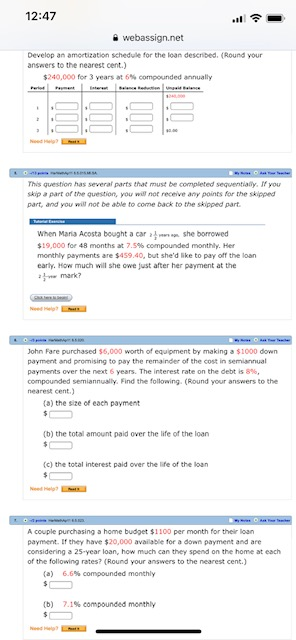

Question: 12:47 - Develop an amortization schedule for the loan described. (Round your answers to the nearest cent.) $240,000 for 3 years at 6% compounded annually

12:47 - Develop an amortization schedule for the loan described. (Round your answers to the nearest cent.) $240,000 for 3 years at 6% compounded annually This question has several parts that must be completed sequentialy, If you skip a part of the question, you will not receive any points for the skipped part, and you will not be able to come back to the sopped part When Maria Acosta bought a carsn she borrowed $19,000 for 48 months at 7.5% compounded monthly. Her monthly payments are $459.40, but she'd ike to pay off the loan early. How much will she owe just after her payment at the mark? John Fare purchased $6,000 worth of equipment by making $1000 down payment and promising to pay the remainder of the cost in semiannual payments over the next 6 years. The interest rate on the debt is 8%. compounded semiannually. Find the following. (Round your answers to the nearest cent) (a) the size of each payment (b) the total amount paid over the life of the loan (c) the total interest paid over the life of the loan A couple purchasing a home budget 1100 per month for their loan payment. If they have $20,000 available for a down payment and are considering a 25-year loan, how much can they spend on the home at each of the following rates? (Round your answers to the nearest cent.) (a) 6.6% compounded monthly (b) 7.1% compounded monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts