Question: 12:48 AA chegg.com Chegg Study Find solutions for your homework business / finance / finance questions and answers / 3. DMC Company Is Evaluating... After-tax

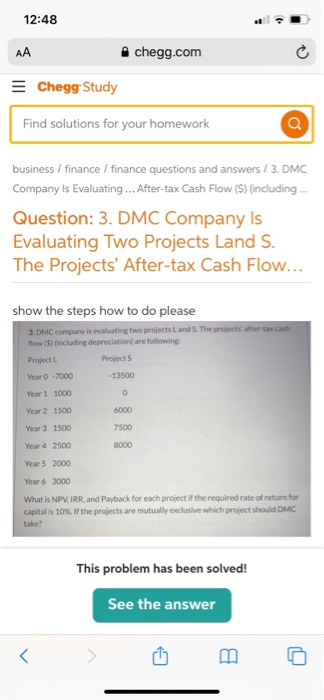

12:48 AA chegg.com Chegg Study Find solutions for your homework business / finance / finance questions and answers / 3. DMC Company Is Evaluating... After-tax Cash Flow (5) (including .. Question: 3. DMC Company Is Evaluating Two Projects Land S. The Projects' After-tax Cash Flow... show the steps how to do please 3. DMC company is evaluating two projects Lands. The projects after-tax cash flow (5) (including depreciation are following Project Projects Year -7000 - 13500 Year 1 1000 0 Year 2 1500 6000 Year 3 1500 7500 Year 4 2500 8000 Year 5 2000 Year 6 3000 What is NPV, IRR, and Payback for each project if the required rate of return for capital is 10%. If the projects are mutually exclusive which project should DMC take? This problem has been solved! See the answer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts