Question: 12:50 & UE & . 6 0 & t Le.Ill 65% ACC7...(2) (2) - Read-only . . . ACC700 REVISION MATERIAL Question 1) Prepare the

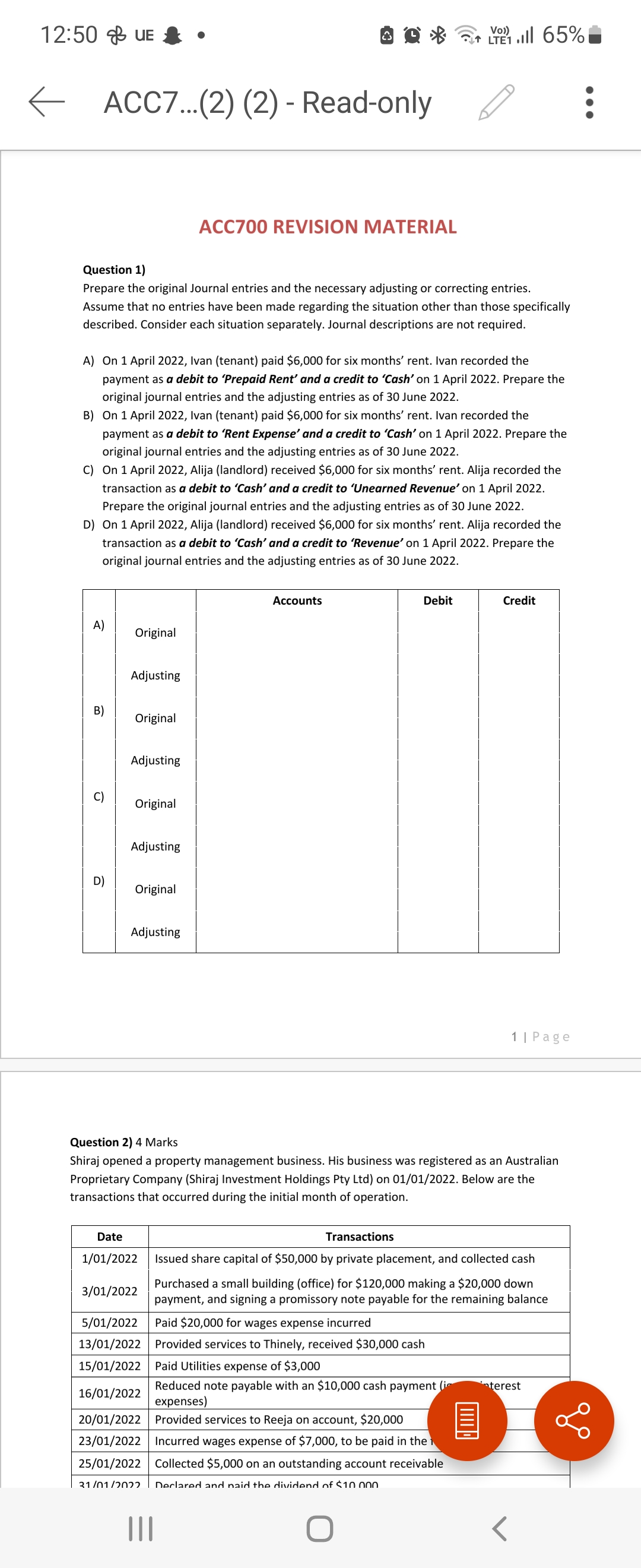

12:50 & UE & . 6 0 & t Le.Ill 65% ACC7...(2) (2) - Read-only . . . ACC700 REVISION MATERIAL Question 1) Prepare the original Journal entries and the necessary adjusting or correcting entries. Assume that no entries have been made regarding the situation other than those specifically described. Consider each situation separately. Journal descriptions are not required. A) On 1 April 2022, Ivan (tenant) paid $6,000 for six months' rent. Ivan recorded the payment as a debit to 'Prepaid Rent' and a credit to 'Cash' on 1 April 2022. Prepare the original journal entries and the adjusting entries as of 30 June 2022. B) On 1 April 2022, Ivan (tenant) paid $6,000 for six months' rent. Ivan recorded the payment as a debit to 'Rent Expense' and a credit to 'Cash' on 1 April 2022. Prepare the original journal entries and the adjusting entries as of 30 June 2022 C) On 1 April 2022, Alija (landlord) received $6,000 for six months' rent. Alija recorded the transaction as a debit to 'Cash' and a credit to 'Unearned Revenue' on 1 April 2022. Prepare the original journal entries and the adjusting entries as of 30 June 2022. D) On 1 April 2022, Alija (landlord) received $6,000 for six months' rent. Alija recorded the transaction as a debit to 'Cash' and a credit to 'Revenue' on 1 April 2022. Prepare the original journal entries and the adjusting entries as of 30 June 2022. Accounts Debit Credit A) Original Adjusting B Original Adjusting C) Original Adjusting D) Original Adjusting 1 | Page Question 2) 4 Marks Shiraj opened a property management business. His business was registered as an Australian Proprietary Company (Shiraj Investment Holdings Pty Ltd) on 01/01/2022. Below are the transactions that occurred during the initial month of operation. Date Transactions 1/01/2022 Issued share capital of $50,000 by private placement, and collected cash 3/01/2022 Purchased a small building (office) for $120,000 making a $20,000 down payment, and signing a promissory note payable for the remaining balance 5/01/2022 Paid $20,000 for wages expense incurred 13/01/2022 Provided services to Thinely, received $30,000 cash 15/01/2022 Paid Utilities expense of $3,000 16/01/2022 Reduced note payable with an $10,000 cash payment (i interest expenses) 20/01/2022 Provided services to Reeja on account, $20,000 23/01/2022 Incurred wages expense of $7,000, to be paid in the 25/01/2022 Collected $5,000 on an outstanding account receivable 21 /01/2075 Declared and naid the dividend of $10 nnn O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts