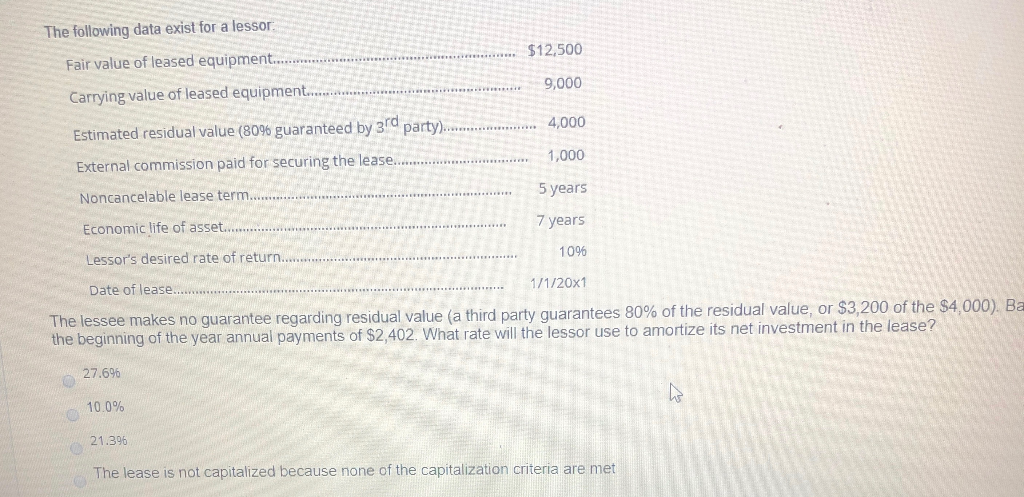

Question: $12,500 The following data exist for a lessor: Fair value of leased equipment.... Carrying value of leased equipment..... 9,000 4,000 1,000 Estimated residual value (80%

$12,500 The following data exist for a lessor: Fair value of leased equipment.... Carrying value of leased equipment..... 9,000 4,000 1,000 Estimated residual value (80% guaranteed by 3rd party). External commission paid for securing the lease. Noncancelable lease term. 5 years Economic life of asset. 7 years 1096 Lessor's desired rate of return.. Date of lease... 1/1/20x1 The lessee makes no guarantee regarding residual value (a third party guarantees 80% of the residual value, or $3,200 of the $4.000). Ba the beginning of the year annual payments of $2,402. What rate will the lessor use to amortize its net investment in the lease? 27.6% 10.0% 21.396 The lease is not capitalized because none of the capitalization criteria are met

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts