Question: 12-6, Please show work please show work on excel ance costs. Machine B costs $150 initially, has a muny, and then $125 per year in

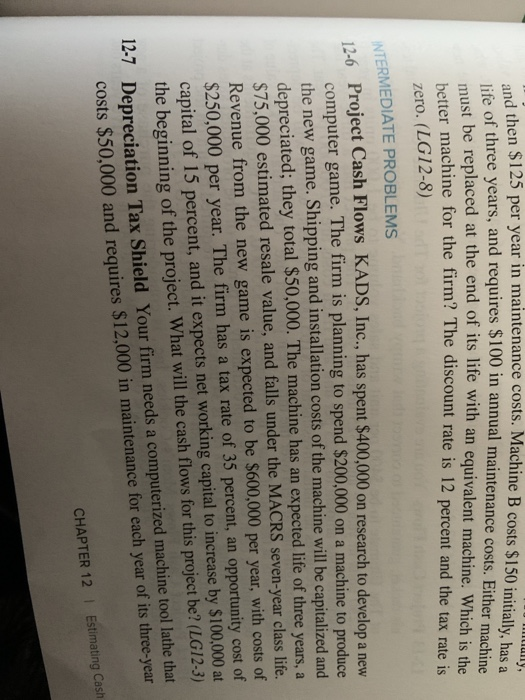

ance costs. Machine B costs $150 initially, has a muny, and then $125 per year in maintenance costs. Machine B costs $150 life of three years, and requires $100 in annual maintenance costs. Either st be replaced at the end of its life with an equivalent machine. Which is the better machine for the firm? The discount rate is 12 percent and the tax rate is zero. (LG12-8) INTERMEDIATE PROBLEMS 126 Project Cash Flows KADS, Inc., has spent $400,000 on research to develop a new computer game. The firm is planning to spend $200,000 on a machine to produce the new game. Shipping and installation costs of the machine will be capitalized and depreciated; they total $50,000. The machine has an expected life of three years, a $75,000 estimated resale value, and falls under the MACRS seven-year class life. Revenue from the new game is expected to be $600,000 per year, with costs of $250,000 per year. The firm has a tax rate of 35 percent, an opportunity cost of capital of 15 percent, and it expects net working capital to increase by $100,000 at the beginning of the project. What will the cash flows for this project be? (LG12-3) 12-7 Depreciation Tax Shield Your firm needs a computerized machine tool lathe that costs $50,000 and requires $12.000 in maintenance for each year of its three-year CHAPTER 12 | Estimating Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts