Question: | 126:44 As companies evolve, certain factor conduvudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected

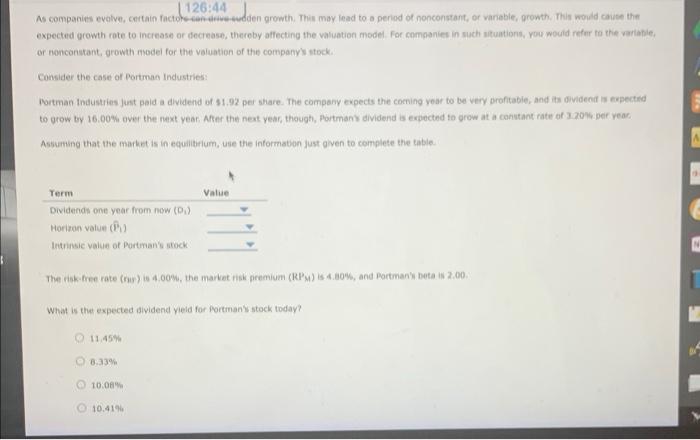

| 126:44 As companies evolve, certain factor conduvudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to increase or decrease, thereby affecting the valuation model for companies in such situations, you would refer to the variante or noncomitant, growth model for the voluation of the company's stock Consider the case of Portman Industries Portman Industries just paid a dividend of 51.92 per share. The company expects the coming year to be very profitable, and its divided is expected to grow by 16.00% over the next year. After the next year, though, Portmans dividend is expected to grow at a constant rate of 2.20 per year, Asuming that the market is in equilibrium, use the information just given to complete the table. Term Value Dividends one year from now (0) Moriron value Intrinsic value of Portman's stock! The tree rate (w) in 4.000, the market risk premium (RPM) 4.10%, and Portmany beta 2.00, What is the expected dividend yield for Portman stock today? 1145 8.33% 10.0 10.419

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts