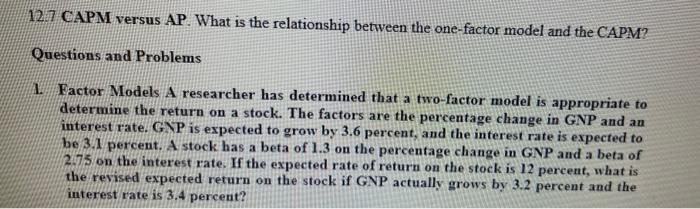

Question: 12.7 CAPM versus AP. What is the relationship between the one-factor model and the CAPM? Questions and Problems 1. Factor Models A researcher has determined

12.7 CAPM versus AP. What is the relationship between the one-factor model and the CAPM? Questions and Problems 1. Factor Models A researcher has determined that a two-factor model is appropriate to determine the return on a stock. The factors are the percentage change in GNP and an interest rate. GXP is expected to grow by 3.6 percent, and the interest rate is expected to be 3.1 percent. A stock has a beta of 1.3 on the percentage change in GNP and a beta of 2.75on the interest rate. If the expected rate of return on the stock is 12 percent, what is the rerised expected return on the stock if GNP actually grows by 3.2 percent and the interest rate is 3.4 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts