Question: 12.9 Questions and Problems 12.1. a. Explain the cost-of-carry model with dollar dividends in your own b. Justify why the spot price considered in the

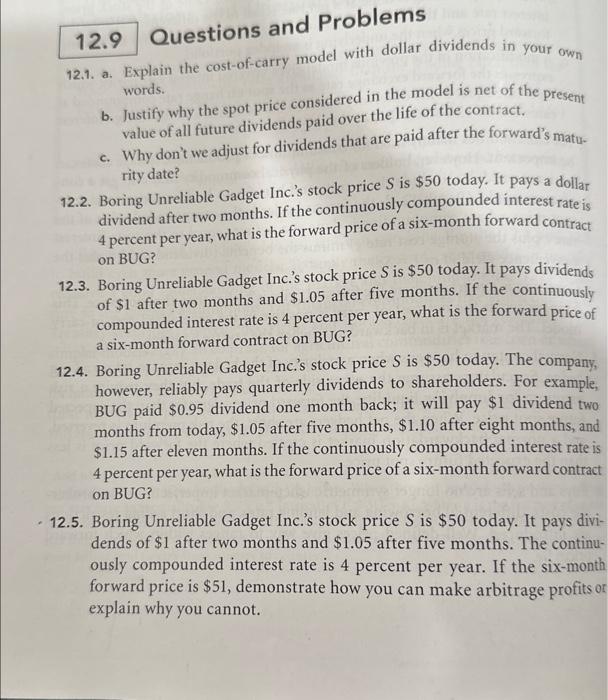

12.9 Questions and Problems 12.1. a. Explain the cost-of-carry model with dollar dividends in your own b. Justify why the spot price considered in the model is net of the present words. value of all future dividends paid over the life of the contract. c. Why don't we adjust for dividends that are paid after the for ward's matu- 12.2. Boring Unreliable Gadget Inc.'s stock price S is $50 today. It pays a dollar rity date? dividend after two months. If the continuously compounded interest rate is 4 percent per year, what is the forward price of a six-month forward contract on BUG? 12.3. Boring Unreliable Gadget Inc.'s stock price S is $50 today. It pays dividends of $1 after two months and $1.05 after five months. If the continuously compounded interest rate is 4 percent per year, what is the forward price of a six-month forward contract on BUG? 12.4. Boring Unreliable Gadget Inc.'s stock price S is $50 today. The company, however, reliably pays quarterly dividends to shareholders. For example, BUG paid $0.95 dividend one month back; it will pay $1 dividend two months from today, $1.05 after five months, $1.10 after eight months, and $1.15 after eleven months. If the continuously compounded interest rate is 4 percent per year, what is the for ward price of a six-month forward contract on BUG? 12.5. Boring Unreliable Gadget Inc.'s stock price S is $50 today. It pays dividends of $1 after two months and $1.05 after five months. The continuously compounded interest rate is 4 percent per year. If the six-month forward price is $51, demonstrate how you can make arbitrage profits or explain why you cannot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts