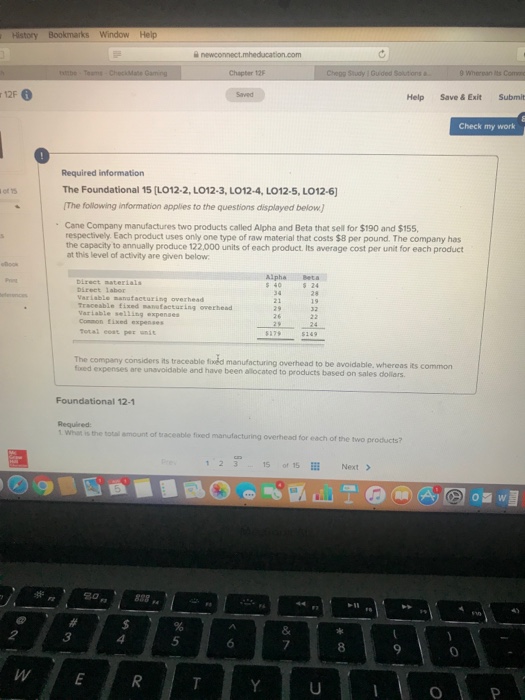

Question: 12-o r Help Save &Exit Submit Check my work Required information The Foundational 15 [L012-2, LO12-3, LO12-4, LO12-5, LO12-6) The following information applies to the

![to the questions displayed below] of 15 Cane Company manufactures two products](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6165ead397_03866e6165e33f26.jpg)

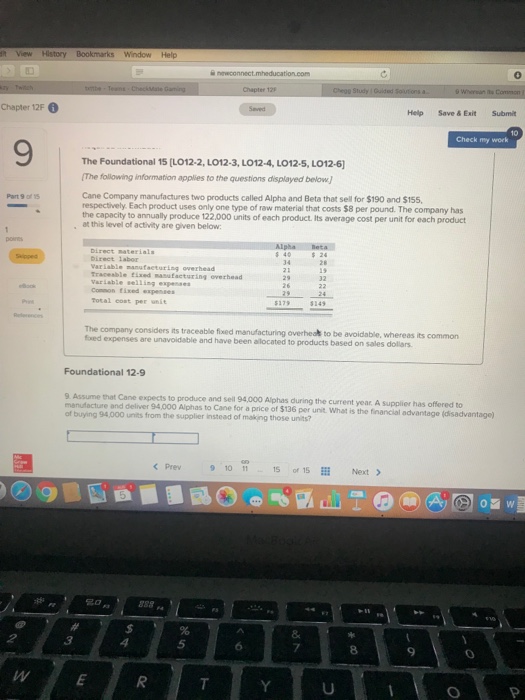

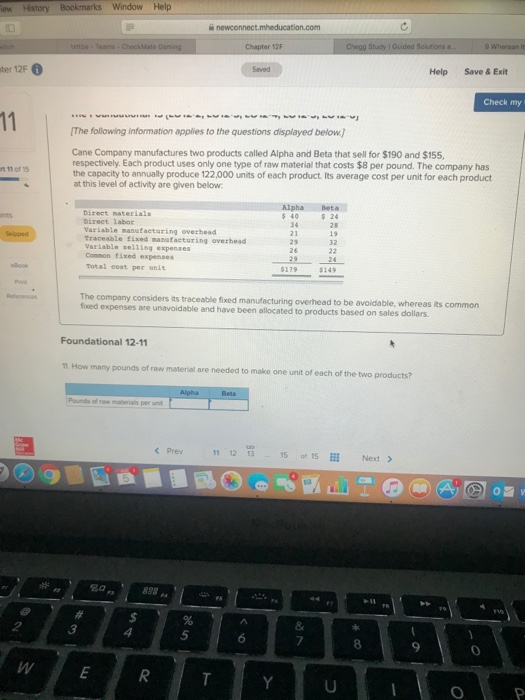

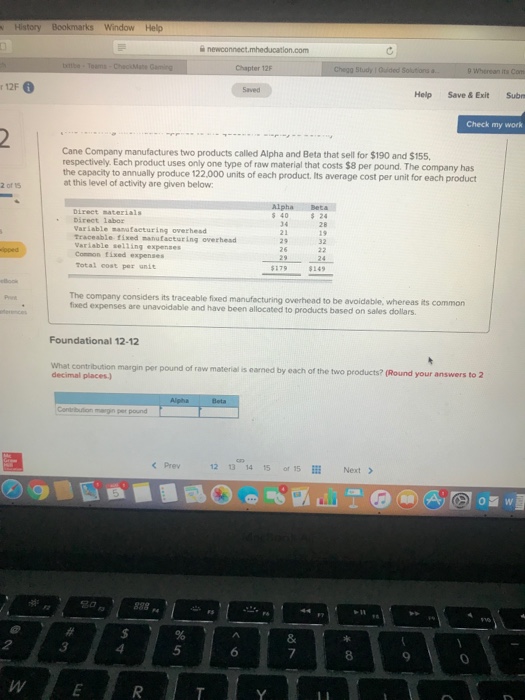

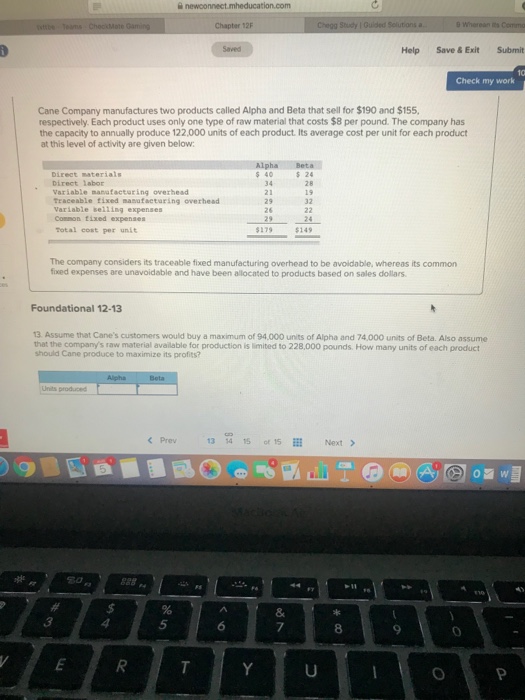

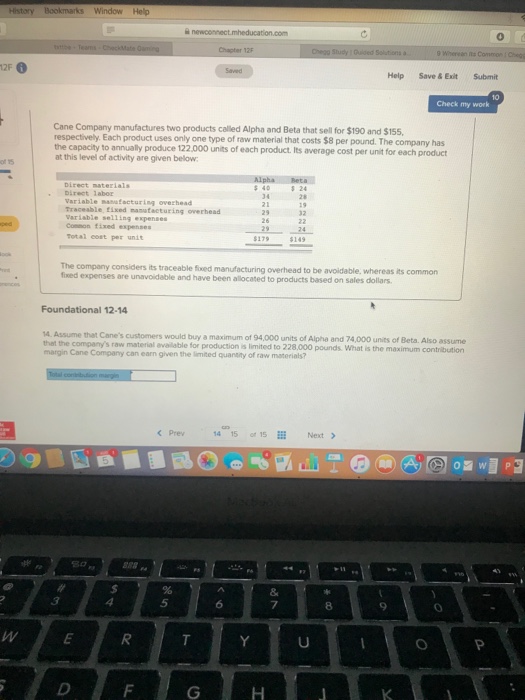

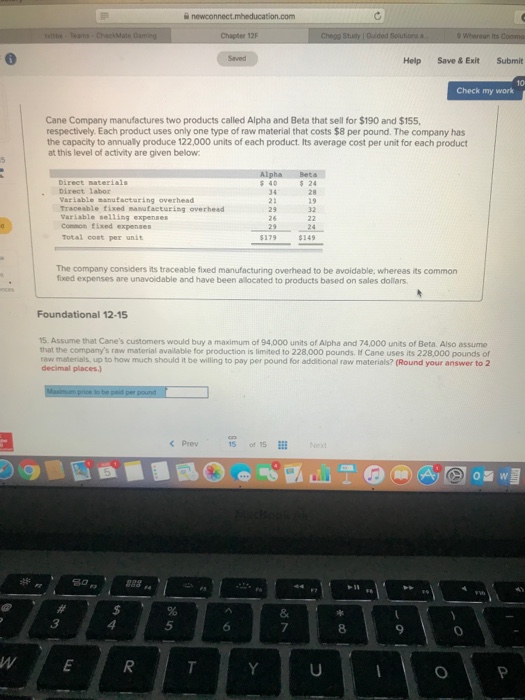

12-o r Help Save &Exit Submit Check my work Required information The Foundational 15 [L012-2, LO12-3, LO12-4, LO12-5, LO12-6) The following information applies to the questions displayed below] of 15 Cane Company manufactures two products called Alpha and Beta that sell for $190 and $155, respectively Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 122,000 units of each product. Its average cost per unit for each product at this level of activity are given below Alpha Beta s 40 Direct 1abor Variable manufacturing overhead Traceable fixed manefacturing ovethead Variable selling expenses Conmon tixed expenses Total eoat per unit 21 24 its traceable fooed manufacturing overhead to be avoidable, whereas its common fsed expenses are unavoidable and have been allocated to products based on sales dollars Foundational 12-1 1 t what is the total amount of traceable fixed manufacturing overhead for each of the two products? 2 15 of 155 Next 5 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts