Question: 13. (10 points) For this question, choose either 1 or 2 below, not both! 1. You work for a U.S. investment company, Dunphy and Harper,

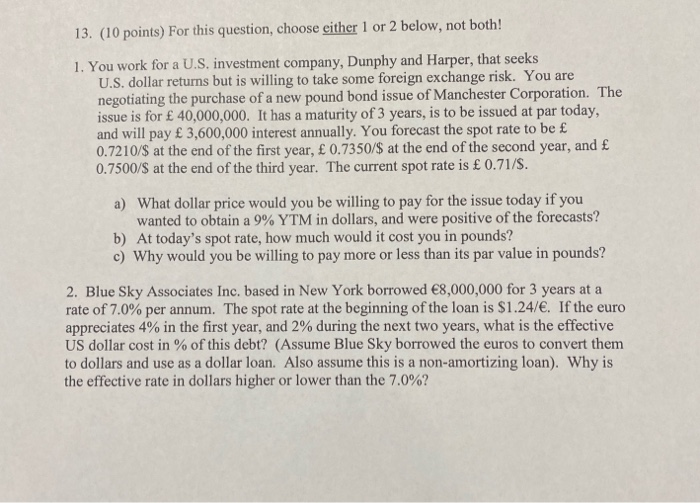

13. (10 points) For this question, choose either 1 or 2 below, not both! 1. You work for a U.S. investment company, Dunphy and Harper, that seeks U.S. dollar returns but is willing to take some foreign exchange risk. You are negotiating the purchase of a new pound bond issue of Manchester Corporation. The issue is for 40,000,000. It has a maturity of 3 years, is to be issued at par today, and will pay 3,600,000 interest annually. You forecast the spot rate to be 0.7210/$ at the end of the first year, 0.7350/$ at the end of the second year, and 0.7500/$ at the end of the third year. The current spot rate is 0.71/S. a) What dollar price would you be willing to pay for the issue today if you wanted to obtain a 9% YTM in dollars, and were positive of the forecasts? b) At today's spot rate, how much would it cost you in pounds? c) Why would you be willing to pay more or less than its par value in pounds? 2. Blue Sky Associates Inc. based in New York borrowed 8,000,000 for 3 years at a rate of 7.0% per annum. The spot rate at the beginning of the loan is $1.24/. If the euro appreciates 4% in the first year, and 2% during the next two years, what is the effective US dollar cost in % of this debt? (Assume Blue Sky borrowed the euros to convert them to dollars and use as a dollar loan. Also assume this is a non-amortizing loan). Why is the effective rate in dollars higher or lower than the 7.0%? 13. (10 points) For this question, choose either 1 or 2 below, not both! 1. You work for a U.S. investment company, Dunphy and Harper, that seeks U.S. dollar returns but is willing to take some foreign exchange risk. You are negotiating the purchase of a new pound bond issue of Manchester Corporation. The issue is for 40,000,000. It has a maturity of 3 years, is to be issued at par today, and will pay 3,600,000 interest annually. You forecast the spot rate to be 0.7210/$ at the end of the first year, 0.7350/$ at the end of the second year, and 0.7500/$ at the end of the third year. The current spot rate is 0.71/S. a) What dollar price would you be willing to pay for the issue today if you wanted to obtain a 9% YTM in dollars, and were positive of the forecasts? b) At today's spot rate, how much would it cost you in pounds? c) Why would you be willing to pay more or less than its par value in pounds? 2. Blue Sky Associates Inc. based in New York borrowed 8,000,000 for 3 years at a rate of 7.0% per annum. The spot rate at the beginning of the loan is $1.24/. If the euro appreciates 4% in the first year, and 2% during the next two years, what is the effective US dollar cost in % of this debt? (Assume Blue Sky borrowed the euros to convert them to dollars and use as a dollar loan. Also assume this is a non-amortizing loan). Why is the effective rate in dollars higher or lower than the 7.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts